Thanks @Scott336 for updating the rest of us with some of the details available to date.

That's interesting that Morgan Stanley aren't actually purchasing shares on behalf of hosts prior to the actual launch on Dec 10. In this case, you do need to pay close attention to what Class of shares are being offered and at what price, since on Dec 10, assuming the launch goes ahead on this date as planned, any hosts wishing to buy shares could also just as easily buy Class A shares on the open market through any broker, possibly at lesser (or greater) prices.

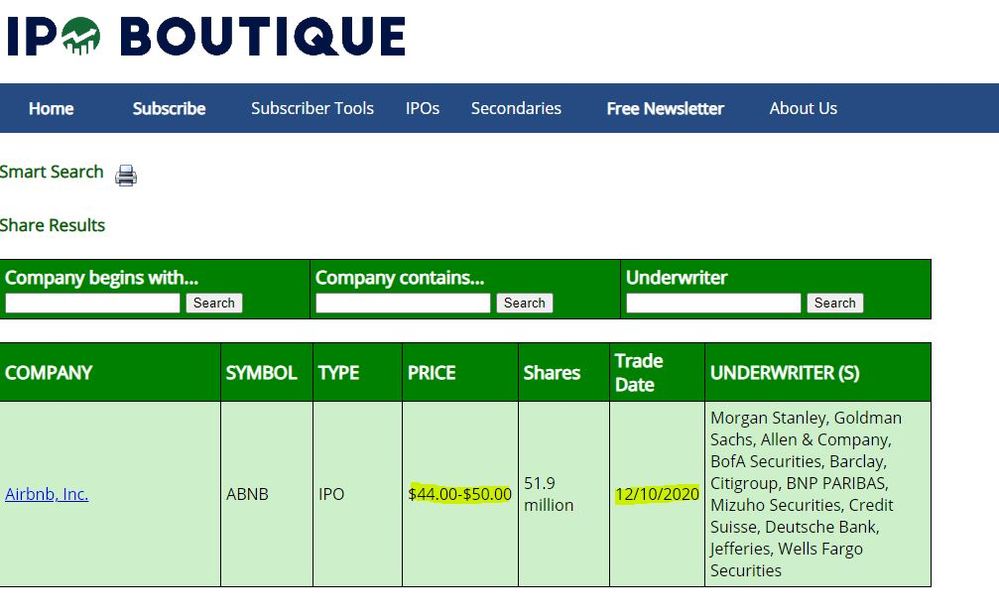

Key information to look at may also be exactly what price the shares being offered to hosts are being priced at, e.g. will they be cheaper or any different from what the expected launch price is. It has previously been reported elsewhere that Class A shares were expected to launch at just over $34, so this new pricing of $44-50 is some distance away from what was mooted just a few weeks ago.

Please also check what the commission is on the brokerage fee for processing the shares.

ABNB have made much of their 9.2 million share Host Endowment Fund containing Class H shares, however we don't yet know if in fact the Directed Shares Program to hosts is actually this same "fund", i.e. in effect it wouldn't be ABNB funding these 9.2 million shares themselves as has been portrayed, but actually hosts funding their own Host Endowment Fund with no voting rights.

It would be wonderful if both you and other US hosts can keep us informed on any further updates as they become available, many thanks.

@Dane130