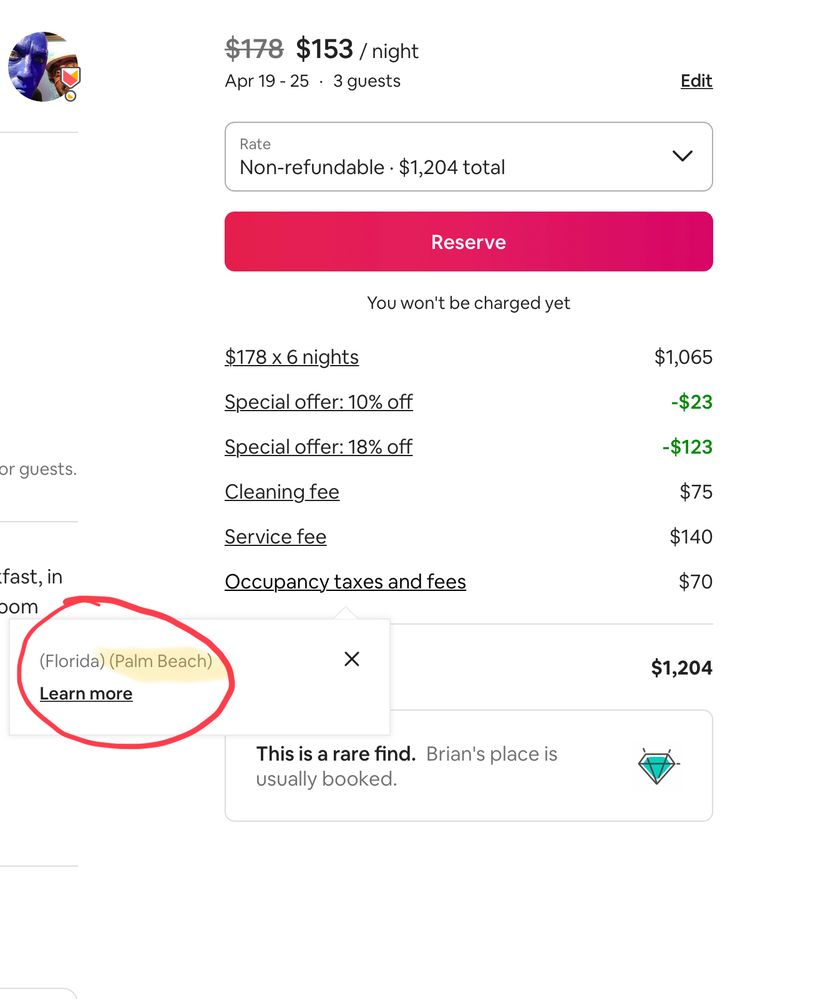

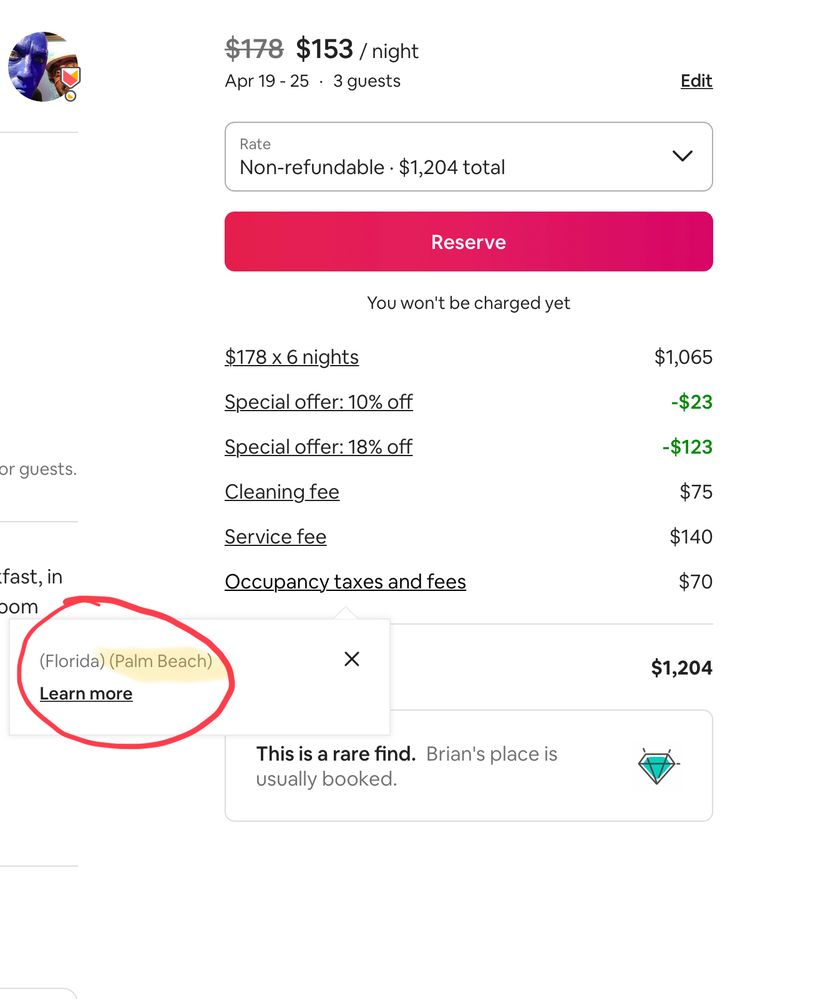

As you can see here, when you click on the taxes, Airbnb shows you that they pay both Florida, and Palm Beach tax. Except, of course, that they don’t. They just collect the Florida part. I just confirmed this on the phone with Airbnb support.

This is misleading. It’s actually, since it revolves around the collection of money, something that misrepresents what Airbnb does, to both guests, and hosts.

It should be removed.

It also means, for those of us who try to capture the TDT for Palm Beach County, via the Community Fee, that guests might wonder what we’re doing, since they see that Airbnb, here, says that they’re collecting tax from our guests.

SUGGESTION: There are a lot of places where Airbnb does not collect the taxes. There needs to be a tax entry line, where the host can collect the taxes that are supposed to be paid by the guests. That money can be captured by Airbnb, posted to the host’s account, for their use in paying the County tax.

Brian Ross