When you sign up for Airbnb, it tells you that they collect taxes in Florida. Well, sort of. ONE COUNTY, Palm Beach County, does not participate.

When you read this: https://www.airbnb.com/help/article/2580/palm-beach-county-fl , it is still currently telling you to go to the County website to find out the rules. They don’t really post them, either.

You must collect the Palm Beach County Tourist Development Tax (TDT), and file it, manually, yourself. If you haven’t, taking Airbnb at the “We pay Florida Taxes, thing,” you will be fined for each late report, and still owe the 6% TDT.

Further, Airbnb does not collect the TDT. Here is how you can collect it yourself, though, through their system:

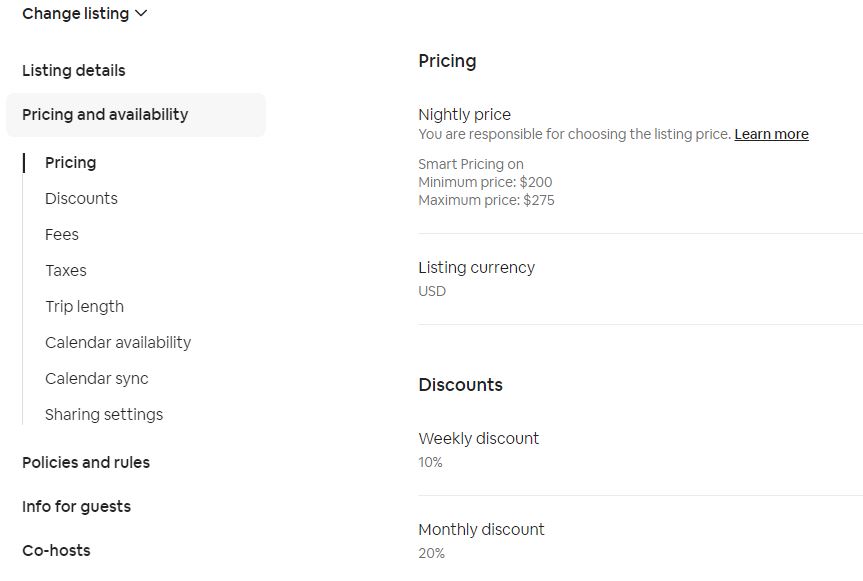

- In your Hosting Dashboard on a WEB BROWSER, go to the listing under the Listing tab;

- Under “Pricing” in the listing, scroll down to “Standard Fees and Charges”;

- Click on Community Fee;

- Set the calculation to %

- Enter 6, per reservation

- Save

That will then collect the money needed to pay the local 6% tax.

Otherwise, the 6% comes out of your profits!

I just went back and caught up. It can be a bit expensive, with fines.

Why is Palm Beach the only county that does this? Can’t tell you. I asked. Got no answer. I would suspect that they like the fines. Otherwise, they would get 100% of the tax money through Airbnb.

Brian Ross