I am now already in a +10 day discussion with Airbnb on an i...

Latest reply

I am now already in a +10 day discussion with Airbnb on an issue of blocked days that are being switched to 'active' in the c...

Latest reply

Hey Everyone,

Wondering if someone can help me understand how taxes are collected for properties in Hilton Head, South Carolina. Are taxes being added to the charges to the guest? The only fees I see displayed on my end are: Nightly Rate, Cleaning Fee, and Service Fee. Is Airbnb collecting the 10% tax and remitting to South Carolina and Hilton Head?

Also, how does Airbnb file on my behalf? I don't see a place to put in our Sales and Use #?

How exactly would the state know to credit our account?

Sorry for all the questions, but I am trying to understand how this works.

Thanks!

Answered! Go to Top Answer

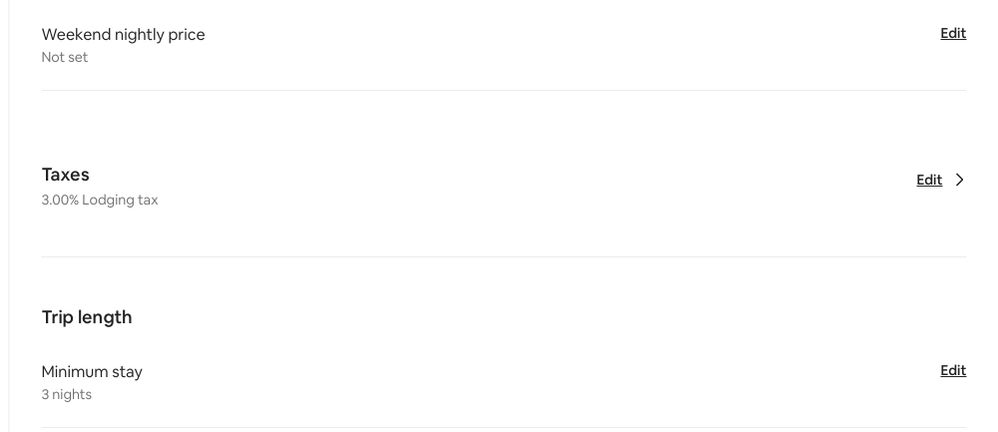

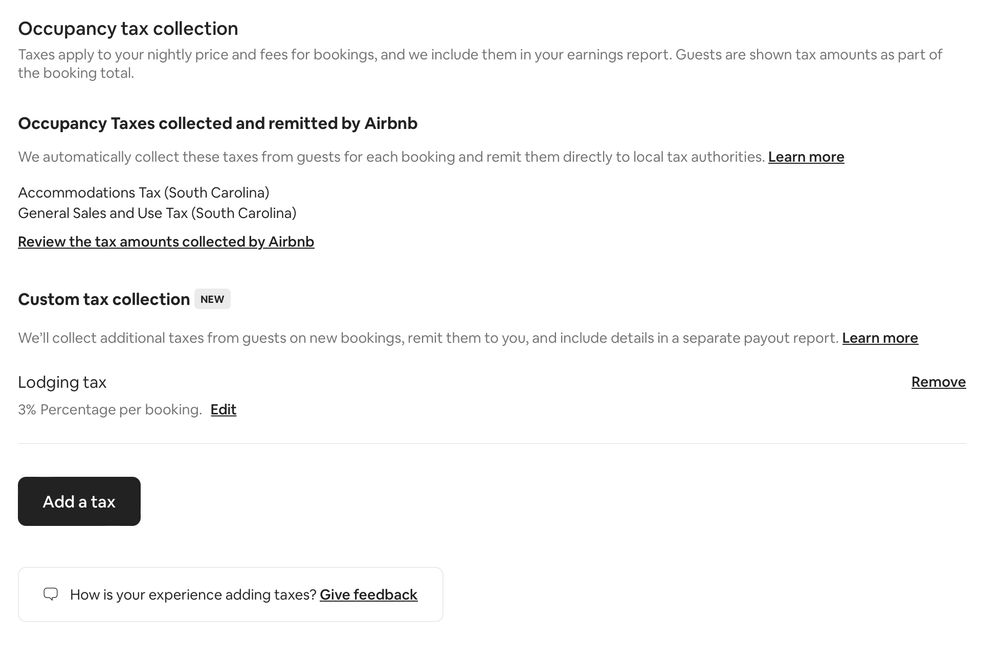

Just for everyone’s info, here are a couple of screenshots of the tax settings and info I have set up for Greenville, SC:

Resulting Edit screen. I added the Lodging Tax.

Remember to 1) Make sure you are on the browser version of Airbnb, 2) clear your browser cache (very important!), 3) turn on Professional Tools - check it again even if you think you have it set.

Does anyone ever report the 7% tax to the state? If so, how? Or do we just assume it isn't our responsibility to do the reporting when AirBnB is collecting and sending it directly to the State?

Hi Stephanie,

Did you ever get good answers for your Hilton Head, SC tax questions?

I think I have figured out that Air BnB pays the 7% State tax directly to the state, but not the 3% Hilton Head sales and accommodations tax/beach preservation fee.

I would like to know what paperwork is required of us, if any, for the 7% tax that is remitted directly to the state. Did you ever figure that part out?

Thanks!

Stephanie

I just can't get the numbers to compute. SC DOR states that 7% tax is due on accomodations, and the cleaning fee. The Town of Hilton Head then wants an additional 1% for accomodations and 2% beach preservation. When I bring up a reservation for $900.00 rental fee, it then shows $90 cleaning, and $135 service fees. And it show $78 for taxes. 7% on $990 is $69.30. Leaving $8.70. So unless Airbnb is also collecting the 1% accomodations and submitting it to the city, the numbers just don't work. If that's correct, then it's up to the owner to submit the remaining 2% Beach preservation fee.

Is there anyone that has figured this out?

Joanna,

I think AirBnB collects the 7% tax on the sum of the rental fee, the cleaning fee, and the AirBnB booking fee charged to the guest. Not sure if this helps.

My question now is that we have a new 1% tax for Beaufort County that goes into effect on May 1, 2019, so the new tax to be collected by the state will be 8% rather than 7%. Does anyone know how this is being handled? Do we have to adjust something in each listing? I called AirBnB and she didn't know anything about it.

Following...

Yes, add the Airbnb guest fee before taking the 7%, and it will reconcile.

@Joanna225 Yes, you have to collect anything over the 7%, unless you want to give your guests a freebie and pay it to the municipality out of your earnings.

Can we add the 4 percent tax onto the listing? I am confused by the whole issue too.... This extra 4 percent that I am paying is beginning to be a lot!

Joining this conversation so I can follow as you are all asking the same exact questions that I have! Hoping someone will eventually have answers. My main question is - is there no where to put in the 3% town tax that appears to be the part that AirBNB is NOT collecting on our behalf?

None of my calculations add up to the amount of Occupancy taxes they have taken out. I only had one AirBNB reservation in 2019 so far, so it should be obvious but no luck. Surely someone knows how they calculate the amount of tax they collect. Is there someone we can call?

Well I figured it out. AirBNB now collects a total of 8% for the following: South Carolina General Sales and Use Tax (5%) + South Carolina Accommodations Tax (2%) + Beaufort County General Sales and Use Tax (1%). For me, AirBNB calculates the taxable cost using my Rate + Cleaning Fee + Guest Service Fee (not my Host fee). Then they take 8% of that. It use to be that AirBNB only collected the 7% State of South Carolina taxes but now they have added the 1% Beaufort County tax. They still don't collect the 3% Hilton Head City taxes which are due quarterly. We still have to collect those and file them ourselves. What a bookkeeping nightmare.

Still not sure how to collect the 3% correctly as AirBNB doesn't give us any "owner-tax- collection" options. If we up our rates by 3% then AirBnB taxes our taxes. Wow. Anyone have a phone number to call customer support at AirBnB?

@D-Ette0 I’ve called Airbnb about this. You have to collect the local tax yourself, either through the Resolution Center, or adding it to your rate. I did find a “Community Fee” option under Pricing, I may collect it there.