Hello everyone,

I live in Canada and a host since September 2017. In August 2018, I got an e-mail from Airbnb which says that I needed to add my taxpayer information and I did. Since the beginning of September, the system started deducting some money under "tax holding" from my payouts and I thought that it was going to Canada Government.

Yesterday, I decided to download my gross earnings as an excel table and noticed that there are USD deductions from my payouts. First of all, I am not related to the U.S. and all the currencies and bank/PayPal accounts are CAD.

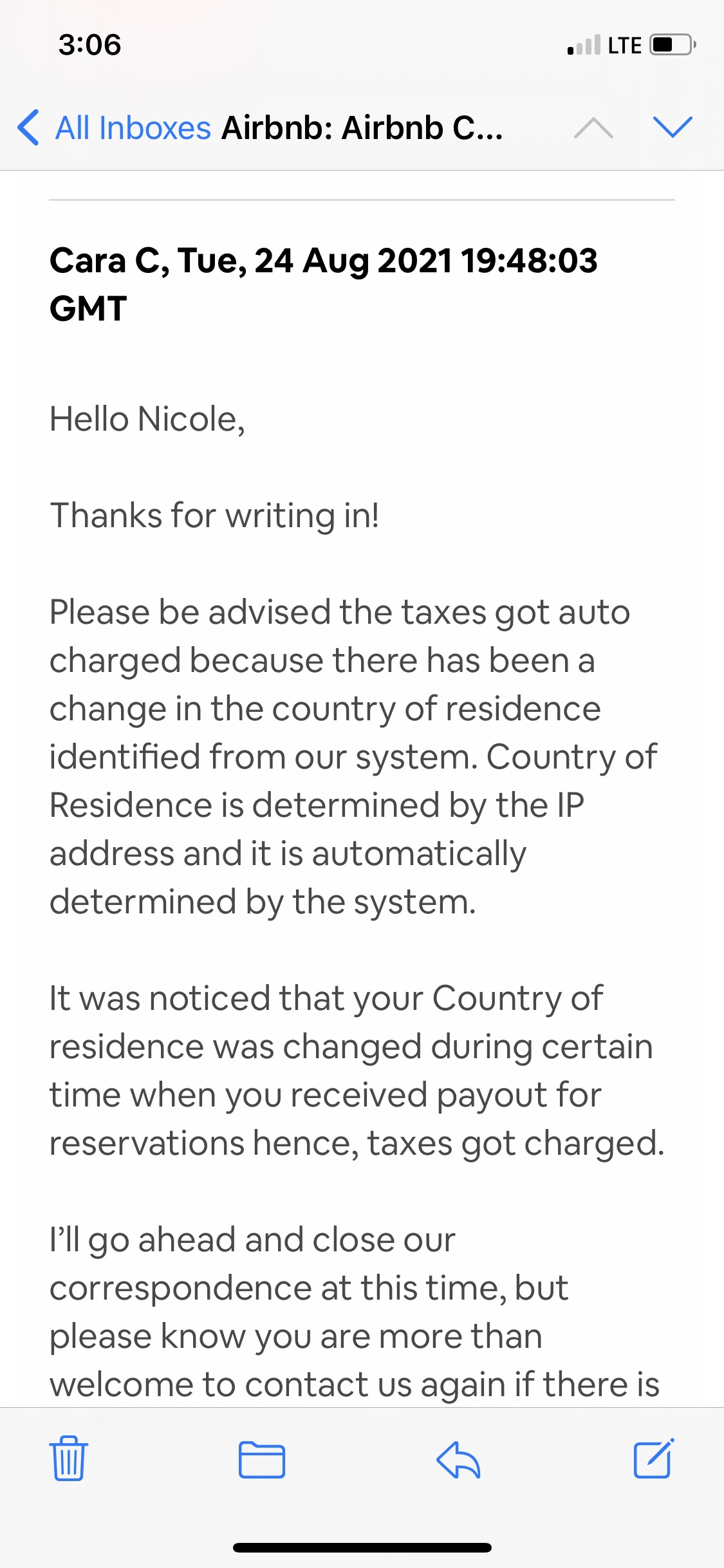

I sent a message to Airbnb help team and this is the answer from them to my e-mail:

"thank you for reaching out regarding your tax withholding.

If you haven't responded to our request to submit your taxpayer information yet, we're required to withhold 24% from your payouts and remit it to the Internal Revenue Service under a regulation known as 6050W.

You can avoid this by submitting your taxpayer information at Account > Payout Preferences. Here's a link that will work if you're logged into your Airbnb account: ***

Once we receive your information, we won’t withhold from your future payouts. However, any amounts that have already been withheld and remitted to the IRS can't be returned to you by Airbnb.

The total amount withheld will be included on any tax forms issued to you so that you may account for these withholdings on your income tax return. We always encourage consulting a tax advisor if you need assistance accounting for any withholdings that have been remitted to the IRS on your behalf.

For more information about US federal tax, visit our Help Center: ***

Living in Canada, being a taxpayer to Canada Government, renting out your house which located in Canada but deducted US federal tax? Does that make sense to anybody?

And now, they said that they are not going to cut my payouts anymore, neither refund the deducted amount. We are talking about roughly US$1,000 which is an important amount for me.

Anybody had the same situation?

Thanks,

John