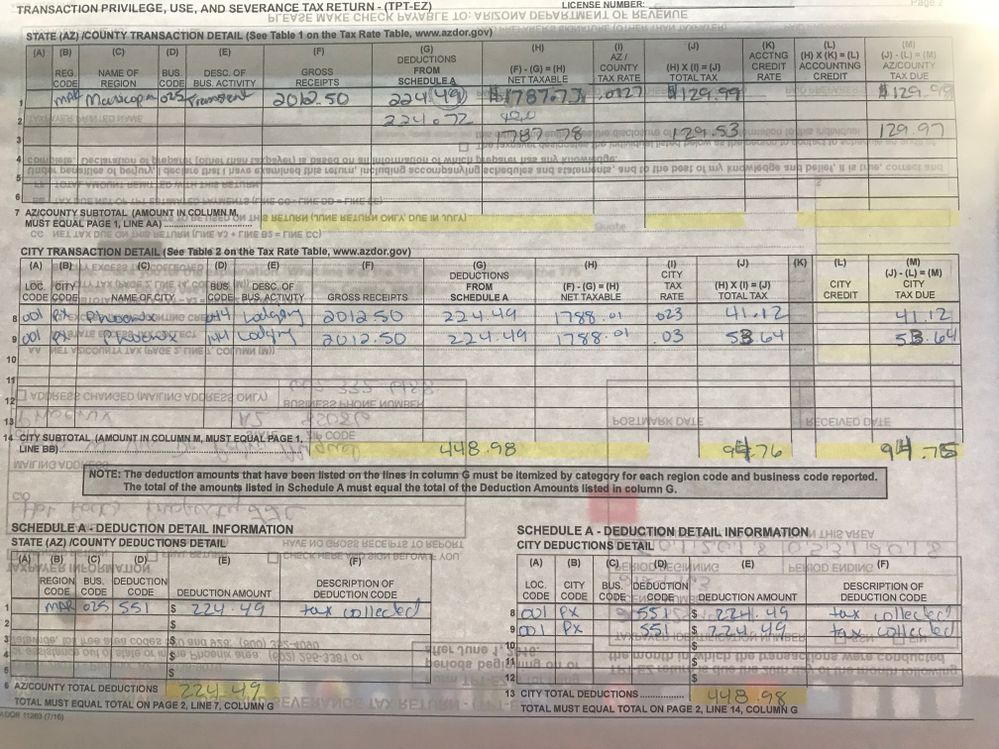

Here is the AirBnb response to my inquiry regarding the taxation variance. They collect 12.52% when the taxes in my area are actually 14.07%.

"In some locations, Airbnb has made agreements with government officials to collect and remit certain local taxes on behalf of hosts. The taxes vary and, depending on the local law, may include calculations based on a flat rate or percentage rate, the number of guests, number of nights, or property type booked.

When guest book a listing in one of these locations, the local taxes collected will be displayed automatically when they pay and appear on their receipt once their reservation is confirmed.

Some hosts are required by their local regulations to charge a tax. We recommend they include the tax in the price of the reservation, but some may require the tax to be paid directly upon check-in. We ask that hosts explain any taxes they may be required to collect in their listing description and their communication with guests prior to booking

State of Arizona:

Guests who book Airbnb listings that are located in the State of Arizona will pay the following taxes as part of their reservation:

*Arizona Transaction Privilege Tax: 5.5% of the listing price including any cleaning fee for reservations 29 nights and shorter. For detailed information, visit the Arizona Department of Revenue Transaction Privilege Tax website.

*County Excise Tax: The county excise tax rate varies by county. It is typically 0.28%-6.5% of the listing price including any cleaning fee for reservations 29 nights and shorter. For detailed information, visit the Arizona Department of Revenue Transaction Privilege Tax website.

*Local Transient Occupancy Taxes: One or more of the following local transient occupancy taxes may apply: Transaction Privilege Tax, Transient Lodging Tax, Bed Tax, or Hotel-Motel Tax. The local transient occupancy tax rate varies by city. It is typically 1.5%-6.0% of the listing price including any cleaning fee for reservations 29 nights and shorter. Transaction Privilege Tax typically applies to all reservations, regardless of the length of stay. For detailed information, visit the Arizona Department of Revenue Transaction Privilege Tax website.

To summarize, Airbnb is only responsible for collecting and remitting taxes for the state of Arizona which ranges from 7.28% to 18.5% depending on the final price of a reservation and city that you are in. As the percentage of taxes vary depending on the price of reservation, there is no set rate of what Airbnb has to collect. If your county or city does require taxes be collected outside of what has been outlined above, you will need to collect it separately.

I hope I was able to provide some clarity for you. If you have any further questions, please let me know. I’m more than happy to address any of your concerns. Thank you for hosting with Airbnb."