Hi folks,

As new hosts, my wife and I decided to calculate how much it actually costs us to provide our space for a single night, in the hope that it would help us with pricing, so we wondered if anyone else had calculated their cost per night lately?

We were taking a leaf out of Alex Polizzi's book, since we quite enjoy watching the Hotel Inspector. Having watched a recent episode, we learned that we had fallen for Alex's biggest gotcha - running an accomodation based business without calculating the bare minimum we need to charge in order to break even. We were operating on the assumption that if money comes in, we must be making a profit somewhere. Terrible planning, now that I think about it.

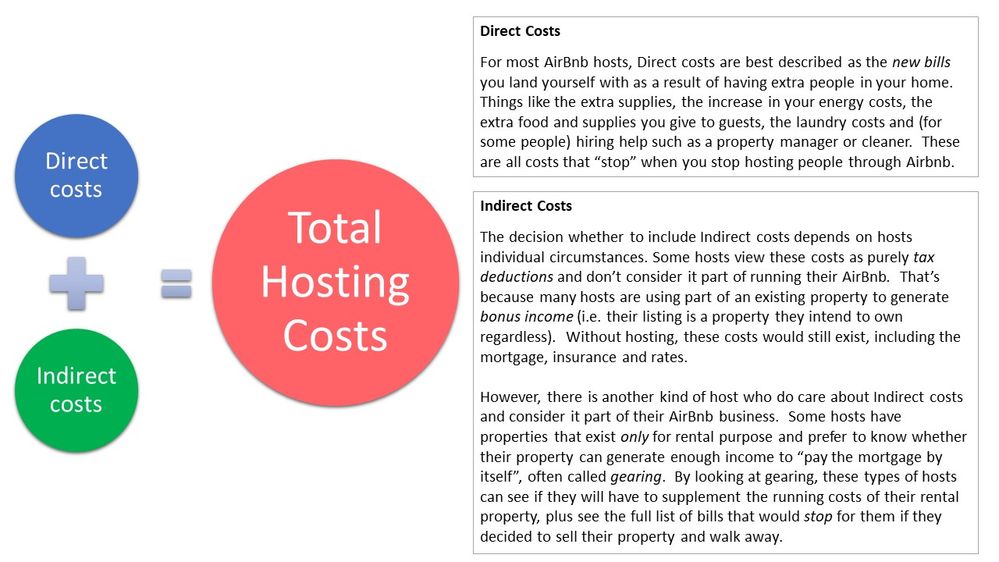

I thought it would be hard to whip up a calculation, given that we don't yet have 1 years worth of profit & loss to look back at, but after about 30 minutes we managed to come up with a very good picture of what our direct costs are likely to be (the costs that would no longer incur if we stopped renting our space) and what our indirect costs are likley to be (the costs we attribute to our Airbnb business for tax purposes, but we would incur anyway if we ended the business tomorrow).

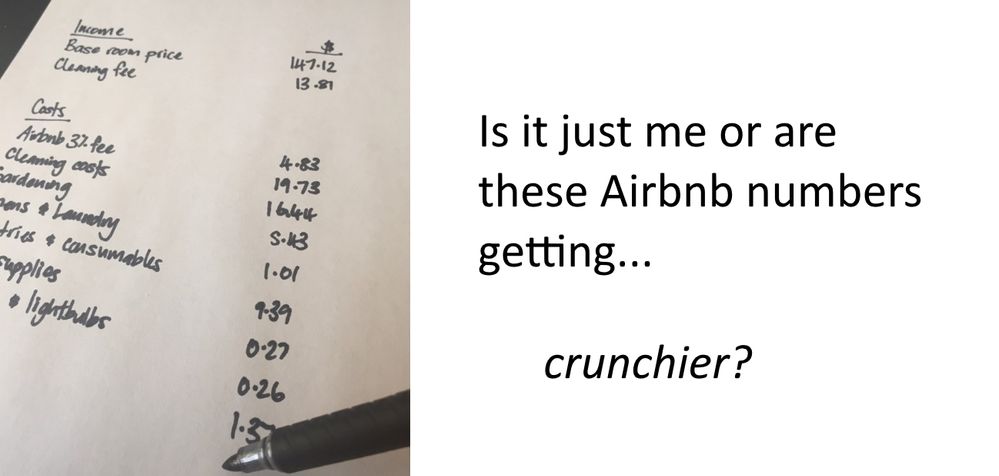

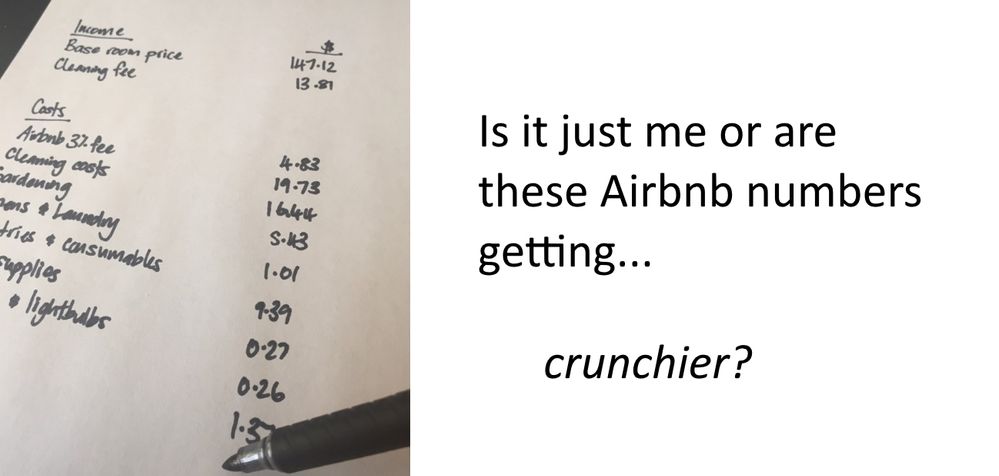

Here's a close example of what we ended up with:

| Cost of 1 night in my Airbnb |

|

|

|

| |

|

|

|

| Income per night |

|

|

|

| Base price (average) |

|

$147.12 |

|

| Cleaning fee (average) |

|

$13.81 |

|

| |

|

$160.93 |

|

| Direct costs |

|

|

|

| Airbnb 3% service fee |

$4.83 |

|

|

| Cleaning costs (average) |

$19.73 |

|

|

| Gardening (average) |

$16.44 |

|

|

| Linens & laundry |

$5.43 |

|

|

| Toiletries & consumables |

$1.01 |

|

|

| Food supplies |

$9.39 |

|

|

| Batteries & lightbulbs |

$0.27 |

|

|

| Garbage |

$0.26 |

|

|

| Superhosttools |

$0.30 |

|

|

| Accounting |

$1.37 |

|

|

| Printing |

$0.07 |

|

|

| Gas & Electricity |

$6.16 |

|

|

| Advertising & promotion |

$0.10 |

|

|

| Maintenance & Depreciation |

$6.47 |

|

|

| Office supplies |

$0.11 |

|

|

| Income taxes |

$5.58 |

|

|

| |

$77.52 |

|

|

| |

|

|

|

| GROSS PROFIT PER NIGHT |

|

$83.41 |

52% |

| |

|

|

|

| Indirect costs |

|

|

|

| Alarm monitoring |

$0.69 |

|

|

| Council rates |

$6.43 |

|

|

| House insurance |

$2.93 |

|

|

| Mortgage interest |

$54.89 |

|

|

| Telephone and internet |

$1.64 |

|

|

| Bank charges |

$0.12 |

|

|

| Parking permits |

$0.17 |

|

|

| Vehicle mileage |

$2.19 |

|

|

| |

$69.06 |

|

|

| |

|

|

|

| TOTAL COST PER NIGHT |

$146.58 |

|

|

| |

|

|

|

| NET PROFIT PER NIGHT |

|

$14.35 |

9% |

The key assumptions that we found changed the numbers (particularly indirect costs) were the occupancy rate and floor area for attributing overheads. Even so, it was helpful to see what both the gross profit and net profit were likely to be.

We're not experts so I'd be interested in what examples other people have!

~ Ben