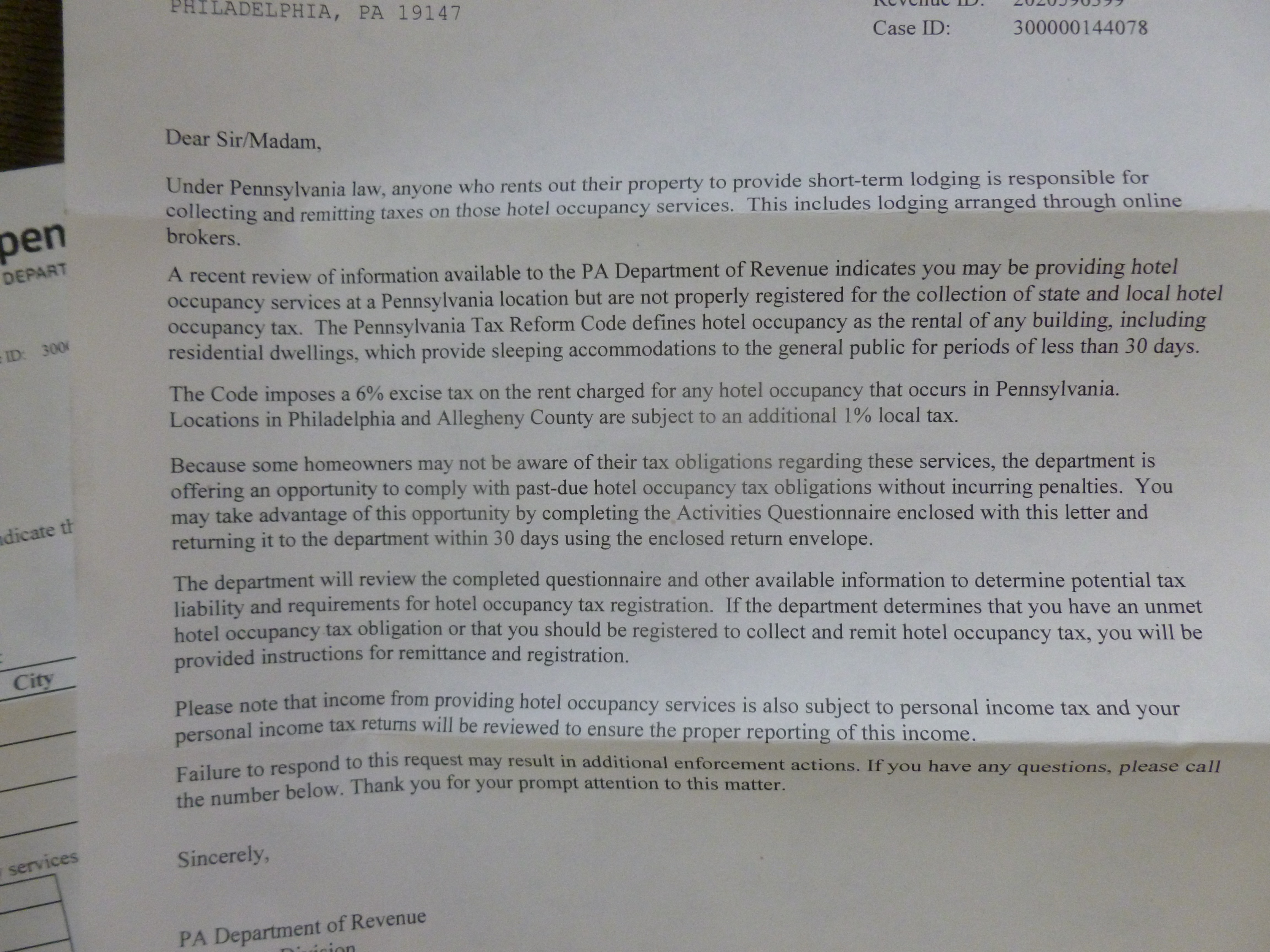

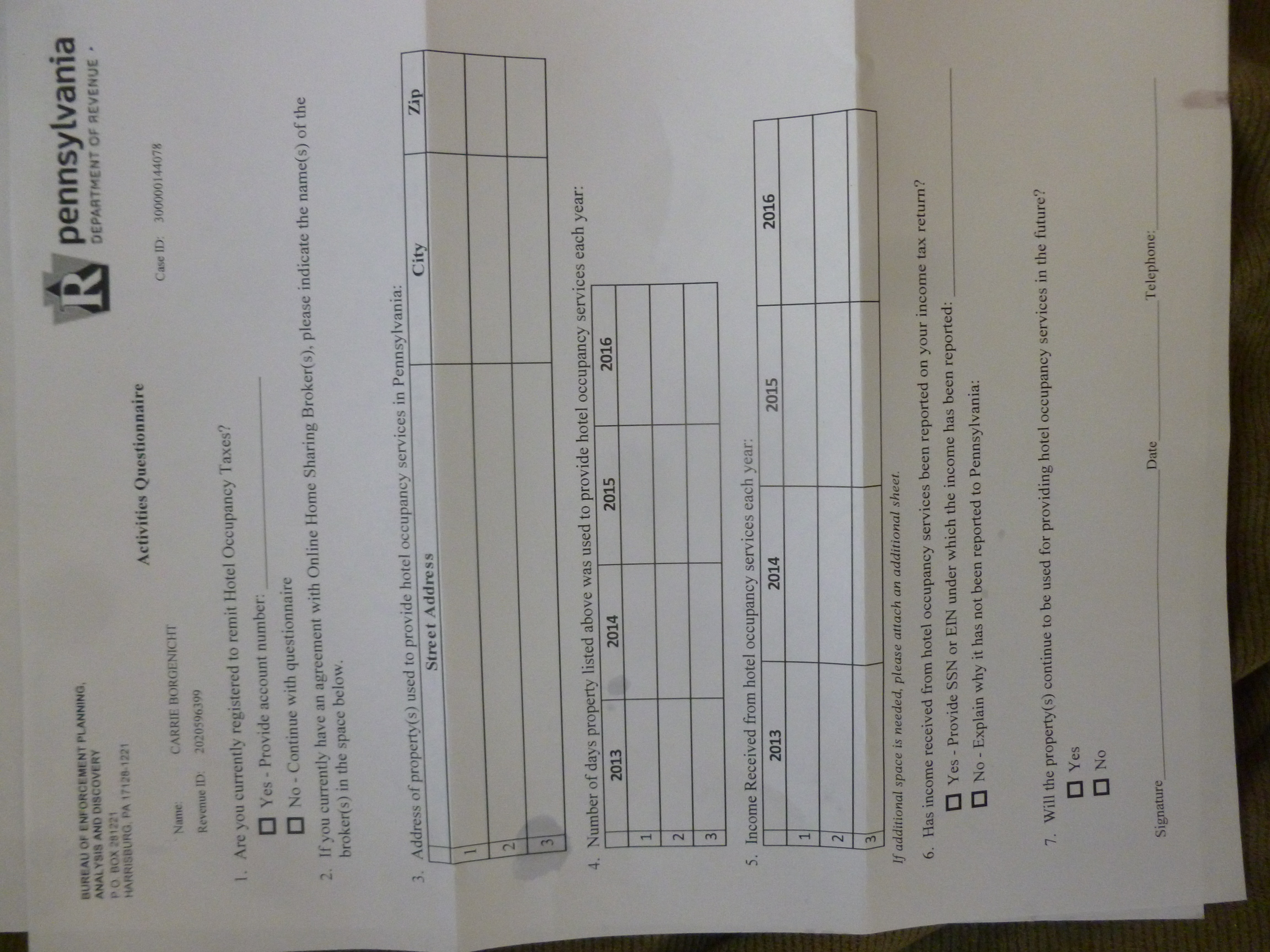

I just received (August 2016) the followup to the PA Dept of Revenue's "Activities Questionnaire" that they sent me out a few months ago and that I responded to.

This new letter is essentially a bill for what they think I owe for 2013, 2014 and 2015, based on my answers to the questionnaire and on "other information available to the department." The amounts that they list are precisely the same amounts that I see when I go into my Airbnb account's Transaction History and click on Gross Earnings, then Export to CSV so you can see all the details.

So, at least in my case, the Dept of Rev *somehow* obtained the figures exactly as shown by Airbnb, and there was no purpose in my filling out the questionnaire as far as I can tell.

In the past, Airbnb has -- according to others -- said that they do not share specific information (per host) to the city or state. However it's hard to imagine how the Dept of Revenue managed to find the *exact amounts* that are in my Airbnb transaction history. At first I thought OK, the state looked at what my Philadelphia hotel tax was and calculated from there. But that wasn't being charged in 2013. On top of that, the state's figure was equal to my entire Gross Earnings, not just the portion representing stays of less than 30 days, which is what Pennsylvania's hotel tax applies to. (To be exact, Philadelphia county's 8.5% hotel tax applies to stays of less than 31 days; a slight difference).

By the way, the Gross Earnings listed by Airbnb and used by the state *include* the host fee that we never receive. I would think that we should only be taxed on the money that we actually receive. I asked them to use the "Amount" column -- what's actually paid out -- instead of the "Gross Earnings" column...we'll see how that goes, seeing as this is an excise tax: http://www.pacode.com/secure/data/061/chapter38/chap38toc.html .

Anyway: *If you ever rent for 30+ day stays* you should check those figures in your Gross Earnings CSV and make sure that the state is only including stays of 29 days or shorter as your "Hotel Occupancy Services." Well, you should probably double-check them in any case before coughing up the taxes. The revenue people are really very nice when you call!

It appears there is a new page on revenue.pa.gov:

SHORT-TERM RENTALS USING HOME-SHARING OR THIRD-PARTY BROKERS

http://www.revenue.pa.gov/GeneralTaxInformation/Tax%20Types%20and%20Information/Pages/Sales%20Use%20...

I hope that clarifies things!