Hi. Hoping somebody out there in the UK might be in the same situation and be able to give me some advice.

I have a property that is registered with my local authority as a business (non-domestic 'Self catering holiday unit and premises'). It's rateable value is below the threshold so I get Small Business Rate Relief. In effect, I pay no rates. Instead, all income is declared as 'earnings from property' on my HMRC self-assessment and I pay the appropriate rate of tax as determined by that assessment.

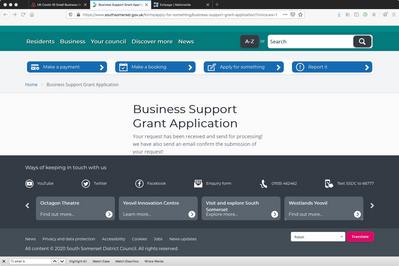

Am I eligible for the Small Business Grant Fund being offered by the government?

The fund appears to be a single amount of £10,000 regardless of size of business so long as they qualify for Small Business Rate Relief. This is way more than I have lost during the current lockdown, so would give away much of it. There doesn't appear to be a way to apply for a smaller amount.

Any advice very welcome - thanks!