Can anyone clarify how the new sales tax and remittance process works. In the past, I collected sales and occupancy tax upon arrival and filed and paid annually. Now it seems that Airbnd will do this for my location.

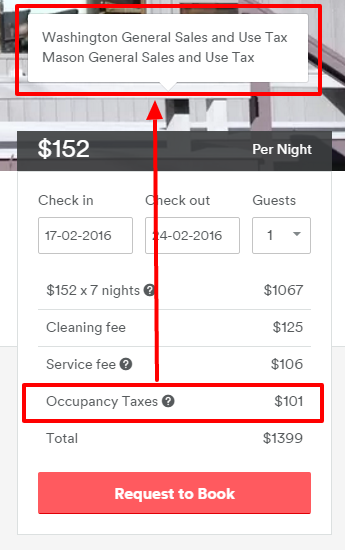

However, I just received my first booking request under this new policy and there was no line item for the 10.5% sales tax & occupancy tax? If they do not include it on the quote, how can we confirm that they are actually collecting the requited sales and occupancy taxes on bookings? Does Airbnb report the and remit the taxes? Or do they send us the tax with our payout and do we include it with our reports?

This seems to confuse things more and could wind up costing hosts if this isn't clarified.