I'm nearing year 3 trying to get this resolved, and I would like help as to who specifically to speak with to get two listings that I have, corrected. Both listings say 31 day stay minimum and most all of my bookings are over 31 days.

I've reached out to AirBnb CS and to no avail this just continues.

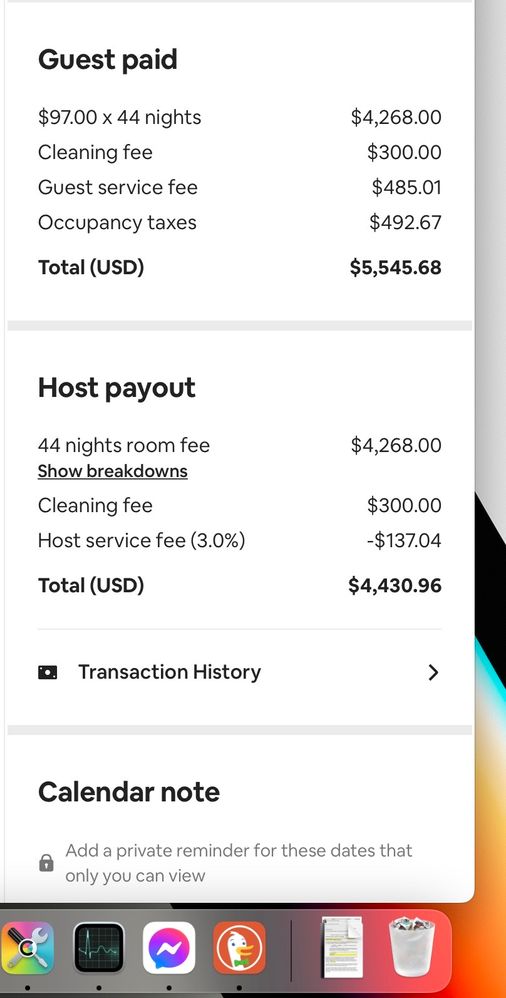

My guest's are charged accommodation taxes that should not be collected and remitted and I'm frustrated that something so simple is not being corrected.

Any help in directing me is greatly appreciated. VRBO is doing the same thing.

I'll attach a photo of the latest booking that this has occurred on.