Hey Everyone,

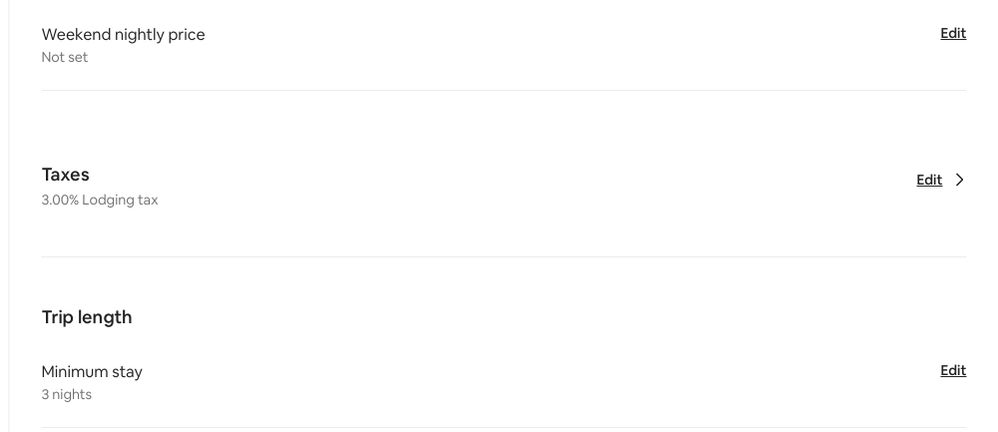

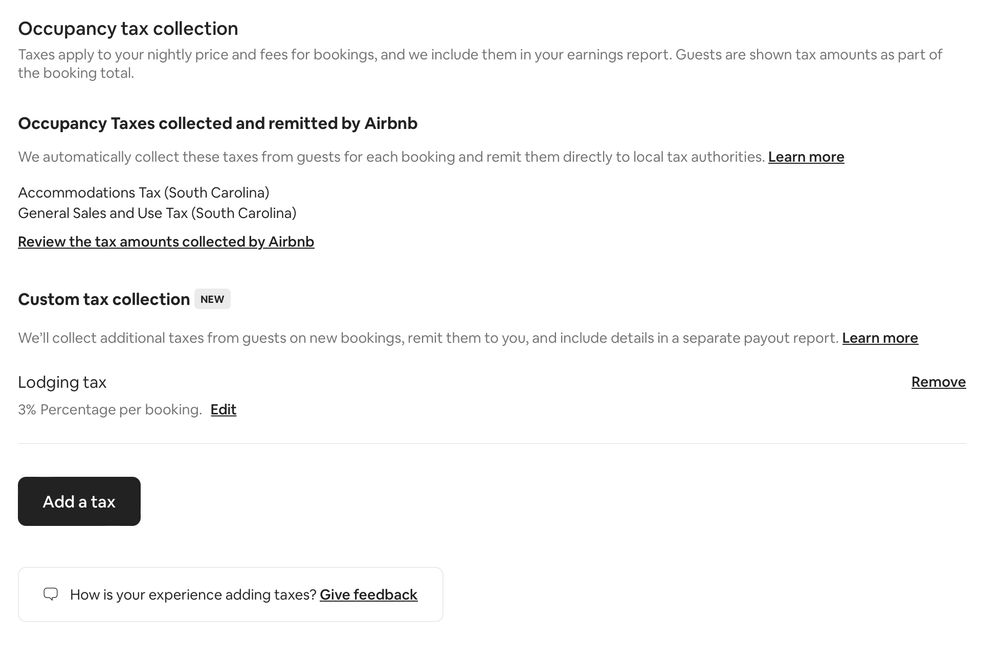

Wondering if someone can help me understand how taxes are collected for properties in Hilton Head, South Carolina. Are taxes being added to the charges to the guest? The only fees I see displayed on my end are: Nightly Rate, Cleaning Fee, and Service Fee. Is Airbnb collecting the 10% tax and remitting to South Carolina and Hilton Head?

Also, how does Airbnb file on my behalf? I don't see a place to put in our Sales and Use #?

How exactly would the state know to credit our account?

Sorry for all the questions, but I am trying to understand how this works.

Thanks!