There has been alot of posts asking questions about monthly ...

Latest reply

There has been alot of posts asking questions about monthly stays on Airbnb and potential scams (especially for new hosts). B...

Latest reply

I list my Mexican property in USD and the money is sent to my US bank account. I receive emails of the expected payout in USD when the reservation is made, however, the actual payout is less. I have tried to figure out why and the closest I can get is that the original estimate does not include the 4% income tax that is withheld. I am taxed at that rate because I supplied a Mexican RFC (tax ID). Without that tax ID, AirBnb states they will withhold 20% for income tax which you cannot recover.

Because of the amount of money I am earning on AirBnb with my Mexican property, I meet the Mexican government requirement to file my taxes monthly, which my Mexican accountant handles. I make sure that I get facturas for everything I possibly can. I have a property management company that provides facturas. Sometimes I have a tax credit and occasionally, I owe additional Mexican income tax, which is usually not that much. When I owed income or VAT tax, I sent the money from the US to my accountant’s business account and he paid it. He really didn’t care for me doing that. All my other Mexican bills, I found ways to directly pay them myself without a Mexican bank account, such as Xoom for CFE, XE for HOA fees, paying the accountant or American credit card for property taxes. I recently opened a Mexican personal bank account with Banorte. I did not have to open a business account as I own my Mexican property near the coast under a fideicomiso and not a Mexican Corporation. By the way, I advise highly against buying property through a Mexican Corp. as the accountant fees are very high and it is much more complicated to open an account. I know of one Mexican accountant where his clients don’t have access to their own business accounts and have no idea how much money they have, etc. I was able to easily open my Banorte personal account by myself. I speak a little Spanish and the bank employee used Google Translate and we were able to get it done in less than one hour.

Now, with the new Mexican bank account, I send money from the US with XE in order to start paying bills related to the Mexican property and it is working well. I really like the Banorte mobile app. So now, I am wondering if I should send my AirBnb payouts directly to my Mexican peso account instead of my US account. XE gives the best transfer rates around, but I understand that you have to be careful because the Mexican government may decide to tax it as income. XE says that any more than $10,000 and you may owe taxes, but I don’t know if that is one transaction or for a year.

I’ve seen people complaining about a 3% charge that AirBnb has for the exchange rate when guests are making a reservation and some people have equated that to be the same for host payouts where the currency of the listing does not match the currency of the payout bank. If you have listed your payout account as Paypal, you are paying some hefty fees and I advise against it. If you are sending through an International or even Domestic wire, you will be charged whatever your banking institution charges. I use a credit union in the US that charges no fees as a direct deposit from AirBnb, and not as a wire transfer.

I set up a new payment method on AirBnb to send the money directly to my Mexican bank account. I am waiting for verification and then I will set it as the new default payout method. However, all future reservations already made will still go to the US account as AirBnb collects those fees when the reservation is made. Once I receive a payout to my Mexican bank account, I will make a follow-up post comparing the payouts to either the US or Mexico using the published average exchange rate between buy and sell for that date.

In the meantime, if any other members have experience with this, I would like to hear.

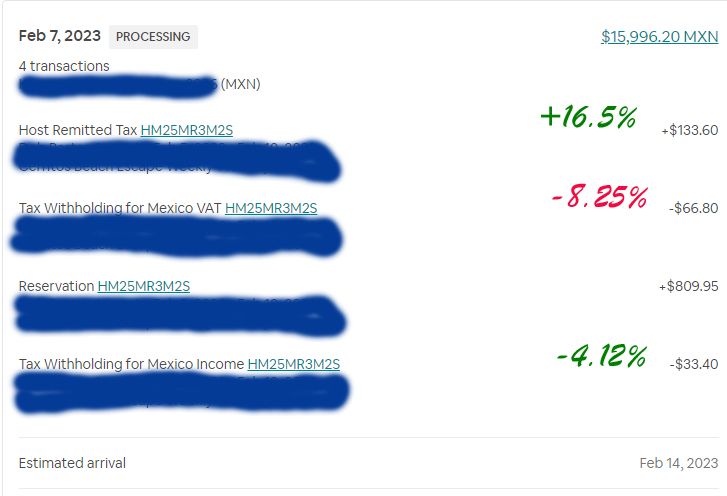

So I got my first payout to my Mexican bank account. Here are the results. First, a payout to my USD account, then the Mexican account. Calculated the same.

The only difference now is, how much it costs to transfer money from US versus having AirBnb pay directly into your Mexican peso account.

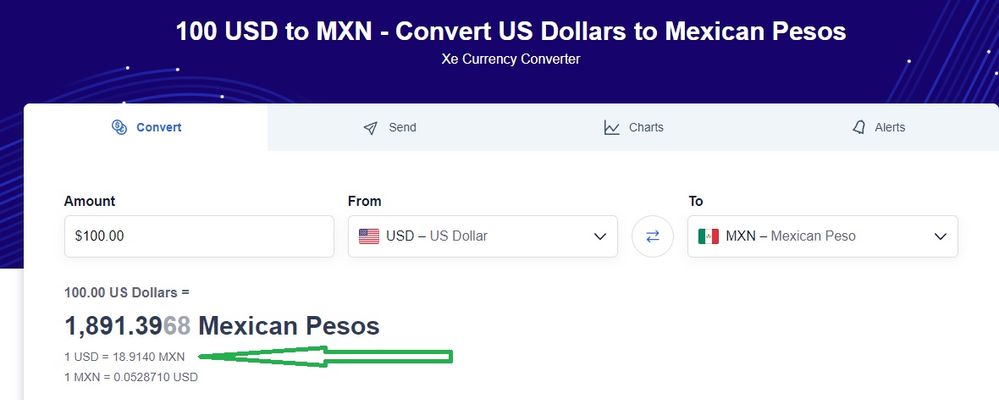

I usually use XE.com to transfer money to Mexico account from US. This is the rate as of today with XE.com, the same date I received the AirBnb money into my Mexican account:

Now, what did AirBnb give me in terms of exchange for the direct payout to my Mexican account on the same date an the proposed XE.com exchange?

$809.95 (reservation) + $133.60 (Host remitted tax) - 66.80 (Tax withholding VAT) - $33.40 (Tax Withholding Income) = $843.35 (if they paid in USD).

$15,996.20 (pesos payout) divided $843.35 (what would have paid in USD) = 18.9674

AirBnb is 0.0543 better than transferring with XE.com.

On this transaction, I would have gotten $15,951.12 pesos from XE.com or 45 pesos ($2.25 USD) less than letting AirBnb handle the exchange.

Bottom line - you will not lose any money by directing your AirBnb funds directly into your Mexican bank account. In fact, you will do a little better. And I got acknowledgment from my Mexican bank (Banorte), they received and accepted the funds the same day AirBnb sent them.

Thank you @Karen3152 for sharing such an informative post.

I am sure, many Mexican Hosts would find your thread helpful in-case they need to check on adding payout methods to their account.

Can’t find what you’re searching for? start a conversation

Thank you @Karen3152 ! This is very helpful.

I have a couple questions given your experience:

1. what do you have to do for the IRS for the USD that you earn in your US bank account? Since you are paying taxes on your income in Mexico, do you get a "pass" on paying US taxes on the USD you earn from your Mexican Airbnb?

2. I understand that some Mexican banks allow you to hold US dollars in your checking account in Mexico. Have you ever tried having your USD earned from Airbnb paid out directly in USD to a Mexican bank account (in USD) in order to avoid any exchange transaction fees? This may be useful especially if you plan to take the USD from your Airbnb earnings and transfer it for use in the US.

Hello @Patrick2862 . I will try to answer your questions. Please note that I am not a professional tax advisor.

1. You do have to declare your ownership in foreign property even if you don’t rent it out. You have to declare the income to the IRS, even if you don’t receive a 1099 from AirBnb. However, once you check the box that it is a foreign-owned property in Mexico, I’ve never owed taxes nor do the expenses reduce my income. It seems to be an exercise for nothing. So it seems to be a pass right from the get-go.

2. I have chosen to have just a peso account in Mexico because I use the account to pay bills in Mexico. I don’t make enough to transfer to US after paying bills to property managers, accountants, etc. You will pay extremely high wiring rates to transfer from Mexican USD account to US USD account. There is no easy way to do that so I don’t bother. For instance, when using xe.com, you cannot send the same currency between two countries.

I do well with my rentals, but it is still not enough to cover all the bills I have to pay in Mexico, including condo fees. So I still use xe.com to send money to my Mexico peso account. Hope this answers your questions.

This information is so helpful! Thank you Karen! Couple things to ask you:

1.Which Mexican Accounting service do you use? Have you heard about Mextax and Mexlaw services? Should I go that route for Mexican accounting services?

2. also, I live in Los Angeles, and I am trying to find out if I can pay the annual Predial online. I just finalized and furnished my studio in Playa del Carmen at the beginning of this month. I see the discounts they give right now if I pay the Predial before 12/31. But my rental manager does not do this service. So I am wondering if I can do it online?

3. I am using a US Charles Schwab bank account to do my rental earnings and pay bills through there. Will I be double taxed since by law I need to report earnings to Mexico and US?

4. can I use the cost for furnishings as tax write offs when reporting my annual taxes?

thank you for your experience and knowledge!

Hello @Rich4169 . Please note that while I answer, I am not a Mexican or US tax expert.

1. My accountant is in San Jose de Cabo. I have not heard of the tax service you mentioned so I cannot make a recommendation.

2. My condo is in La Paz municipality and I am able to pay on-line using a US credit card. The link for my municipality is:

https://servicios.lapaz.gob.mx/predial.php

Try editing this link for your municipality.

3. I did not receive a 1099K for US taxes last year because I did not meet a minimum threshold. However, I reported my earnings and expenses on Schedule C as a rental property in a foreign country. It did nit raise or lower my tax burden as I was putting the data into Turbo Tax software, like it would if I had rental property in the US. The software behaved as though I was not inputting any data. I directed the money to my Mexican bank account last year. The previous year for 2021, I directed the money to my US bank account and received a 1099K, but the same thing happened in the Turbo Tax software program as 2022 tax year.

4. In Mexico, yes, you can write off furnishings and improvements and cost of running your AirBnb services such as Internet, property management, etc. In US, I also wrote off all this stuff and the first year, I had a lot of improvements but because the property investment was not in the US, thenTurbo Tax program did nothing when I input all the data. I would have had enough write-offs to reduce my US tax burden, but like I said, I put in the income data first, it did not increase my tax burden. I put in all the write-offs and it not reduce my tax burden. It probably has something to do with NAFTA and the agreement that owners will not be double taxed. I cannot guarantee that this will be everyone’s experience as there can be other factors that come into play. I can only relate my experience.

Hi @Karen3152

Thank you very much for the informative post. I've been scouring the internet to understand the tax implications in the US and Mexico when listing a property in Mexico, but receiving your payout in the US. From your post, it appears that regardless of where the money is deposited, one must still comply with Mexican tax requirements for accounting, reporting, and issuing facturas, all through a Mexican accountant.

Regarding US income tax, could you provide some insight into how this income is reported, or if it even needs to be reported?

I've been reluctant to open an account in Mexico and send myself money for two reasons: firstly, the potential for Mexican authorities to flag any money I send from the US and tax it, and secondly, the IRS's requirement to report foreign accounts that hold more than $10,000 USD at any given point. Any other insight on your experience here would be really helpful.

As I'm new to this, I want to understand as much as possible about the requirements in both countries before listing a property. Your post has been very insightful.

Thank you.

Hello @R110

Response to first paragraph. True.

Re US income tax, please see my reply to Patrick2862.

I have had a Mexican bank account for about a year. I have never owed any taxes to the Mexican government for money sent to this account. I’ve never had more than a couple thousand equivalent USD in the account because I pay all my Mexican bills through it and used the money for property improvements and I also take pesos out of the account for spending. I send my Mexican bank account statement to my Mexican accountant every month. Any taxes I owe to the Mexican government for rentals beyond what AirBnb withholds is usually very small if any at all. Sometimes I have a credit. I got back about $60 from the Mexican government after my accountant did my annual taxes. You can also maintain more than one payout method, i.e. Mexican bank account or US and switch back and forth as needed. I do not send my US bank statements to my Mexican accountant. I do my own taxes with Turbo Tax. I am not a professional tax advisor. These are just my experiences.

Good luck to you.

Clarification: I have never been taxed on any money I sent from the US to my Mexican bank account by the Mexican government.

When filing taxes in US, It is a challenge to track in USD what you are spending in pesos. I use this website and value each transaction on the date of transaction in pesos to USD. https://www.exchangerates.org.uk/USD-MXN-exchange-rate-history.html

Hi @Karen3152 ,

Thank you for the additional information regarding US taxes. I have also always used TurboTax, this is going to be fun this year.

-R

Hi Karen,

Thank you for the great information.

I have my property in Mexico and I am in the process of setting up my account to receive the payouts to my US bank account. i do have my Mexican RFC and i was wondering what is the best option for me. should i use my SSN or RFC to set up the payout? can i even use a US bank account with a Mexican RFC?

Thank you

@Mehdi307 In order to be in compliance with Mexican law as I understand it, you need to upload your RFC. I was told I can still send your earnings to the US, but you need a Mexican accountant to file your Mexican taxes each month. Before I got a Mexican bank account, my Mexican accountant had to pay any extra Mexican taxes I owed and I had to pay him back. The extra taxes were usually very minimal, but they still had to be paid and it can’t be done through a foreign bank account or on-line with a credit card. I finally decided to open a Mexican bank account. It makes paying my bills in Mexico much easier., including keeping an active Mexican phone number.

I don’t want to accumulate too much money in my Mexican bank account, so if it gets too high, I will switch sending the money to my US bank account for a while. There is no problem directing the money to different bank accounts either in Mexico or the US.

Please note that I am not a tax expert either in the US or Mexico. I am only communicating my personal experiences.

Karen, thank you so much!

What if I’m the host, and I’m a Mexican citizen using my RFC (Federal Taxpayers Registry) for property owners? I don’t own the properties; I’m just the host, but I’m using my RFC to list the properties. Airbnb is deducting income tax, VAT, etc., even though I don’t own the properties—I’m simply acting as the host on behalf of the owners.