Hi - our rental is in the Town of Telluride and our total taxes are 12.4%, with the breakdown being 2.9 to CO. state sales tax, Telluride sales tax: 4.5, Telluride excise: 2.0, San Miguel County Sales: 1.0 and then a San Miguel County lodging: 2.0%

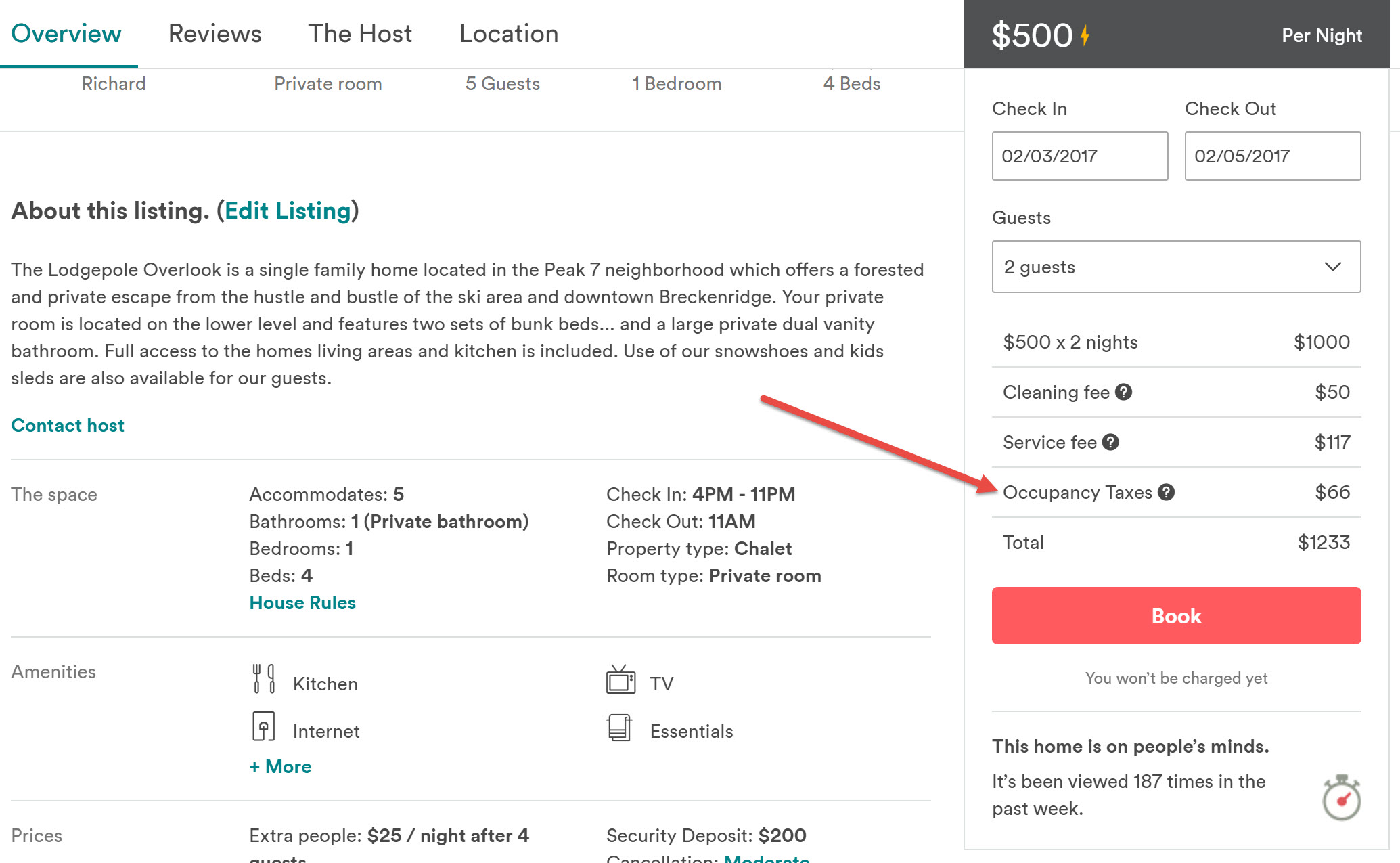

Airbnb told me on the phone, and I've checked it against the gross earnings statement for March, that they charge renters only the 2.9% Colorado Sales Tax (Telluride is not one of the places they have a special arrangement with).

So my plan is to pay Telluride the 6.5 (4.5+2.0) that it wants for all our gross earnings (airbnb and vrbo), and then pay the state the rest (2.9+1.0+2.0), but hopefully I can deduct from that state payment the 2.9% of the airbnb gross that allegedly has been paid on our behalf by airbnb. I also wonder how the state will know that the rest of our bill has been paid by Airbnb.

This is a pain, but I can figure it out. What annoys me is that our airbnb renters are getting a 9.5% discount because they are only paying 2.9% but I have to pay 12.4%! While the VRBO renters pay the entire 12.4% as a separate line item on their invoice. And while it isn't that much money, I don't want to pay the airbnb service charge on taxes that I should collect by increasing the price.

Hopefully I have gotten all of this right. If someone has a better idea, please let me know!

Thanks