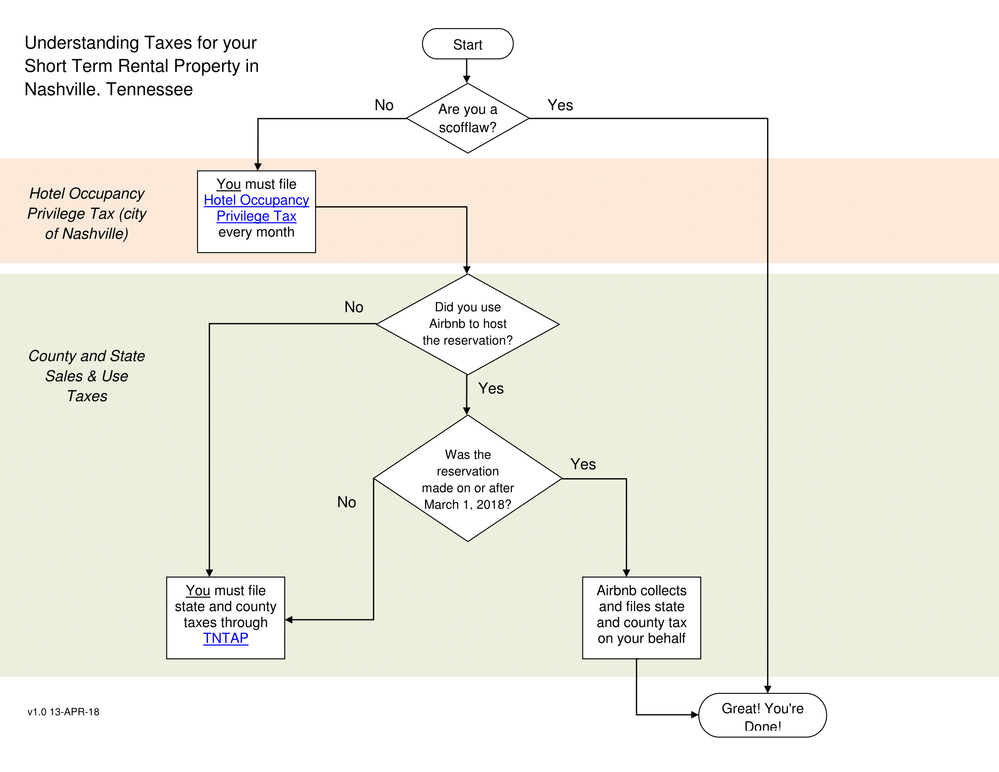

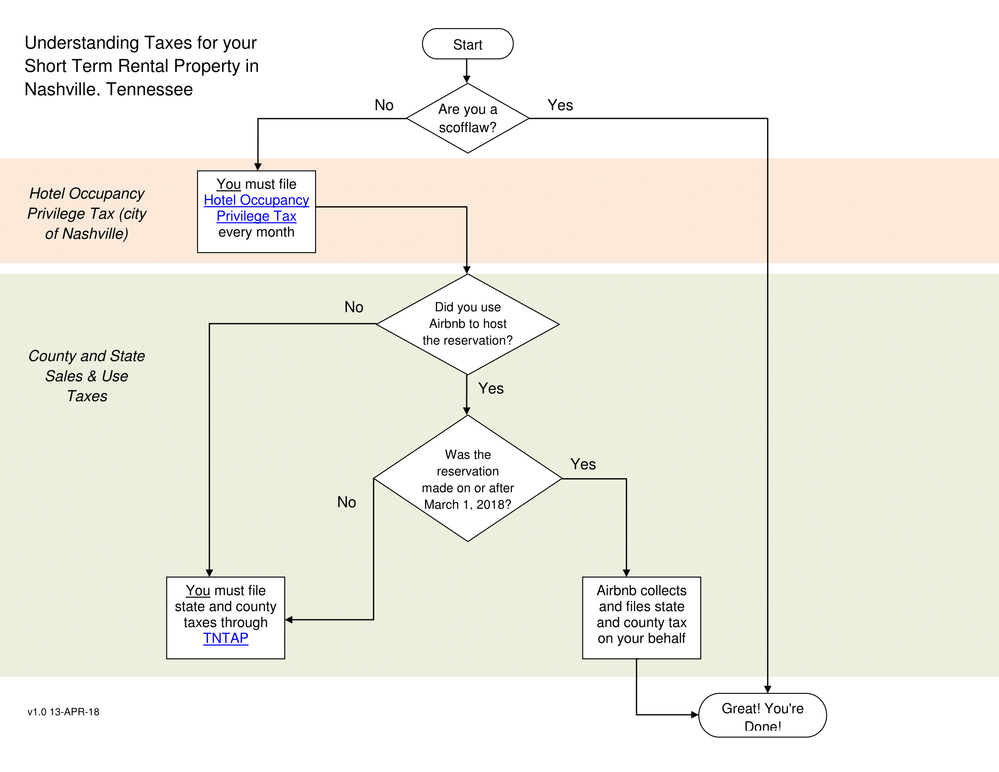

I made a li'l flowchart to help you make sense of the various taxes needed to file and pay when you have a short-term rental property in Nashville, Tennessee. j

This assumes you have already applied for your tax accounts with the city of Nashville (Hotel Occupancy Privilege) and the county/state (through TNTAP, the statewide automated tax filing system).

If you are using other services besides Airbnb to rent your property (e.g. V-R-B-O), they don't all have automated collection agreements with the state yet, so you will need to collect and file county and state sales taxes for any of those reservations through TNTAP yourself.

THERE IS SOME CONFUSION AROUND WHAT TAXES AIRBNB IS COLLECTING. AS OF the posting date of this thread, the Airbnb instructions incorrectly state that they are collecting Occupancy taxes. (They are using the term in a general sense, as the terms in each tax jurisdiction may differ). However it is not truly occupancy tax that they are collecting in Nashville. They are only collecting county and state sales taxes. YOU ARE RESPONSIBLE FOR HOTEL OCCUPANCY PRIVILEGE TAX as of now. I hope the moderators correct this small semantic error because it is causing a lot of confusion!