Hi Johnathan,

I appreciate your help and want to clarify and understand if sales taxes and occupancy taxes paid on cleaning fees can be recouped at tax time?

Here’s my understanding of what I’m paying:

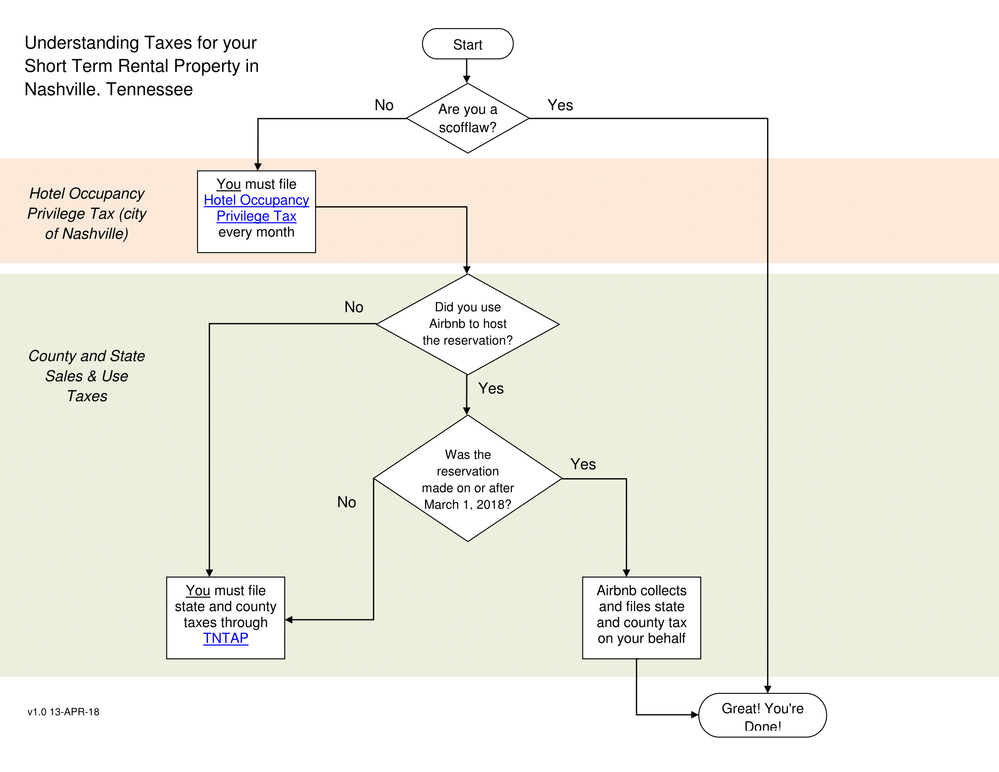

Sales tax, state and local, which Airbnb collects, on not only the rent income, but on cleaning fee. This doesn’t seem right, because we literally pay our housekeeper the amount we psy our guest.

Occupancy Tax: we figure that on the gross payout? Do you mean the amount before they deduct their host fee? Or the amount collected for rent + cleaning fee - Airbnb jost fee? If it includes the cleaning fee, which we already paid 9.25% on, and now we pay another 4% on, we’re paying a tax of 13.25% on the cleaning fee, but then turn around and pay the full amount collected from our guest to our housekeeper. Essentially, we’re out 13.25% of the cleaning fee. How do we recoup taxes paid on ‘income’ that isn’t really income?