Hi Rosanna,

Thank you for replying, I appreciate your feedback.

Was the letter you received from Airbnb or was it from the ATO and was it sent to you before they disseminated your information?

I noticed that your reply is similar to that of Dennis and Gwen in that it refers to the implications of taxation.

To clarify, I am not questioning taxation law as much as I am privacy law. I have accountants that take care of taxation matters.

The concern I have relates to the simple principals of due process and whether an organisation is releasing personal information about its clients without first providing the client with a copy of what has actually been requested and under what authority.

We have privacy laws in Australia that apply to government departments as much as they apply to the corporate sector and individuals.

It seems that if personal information about Hosts is being requested, that it would be appropriate to notify the Host before that information is disseminated, rather than email the Host after it has been released.

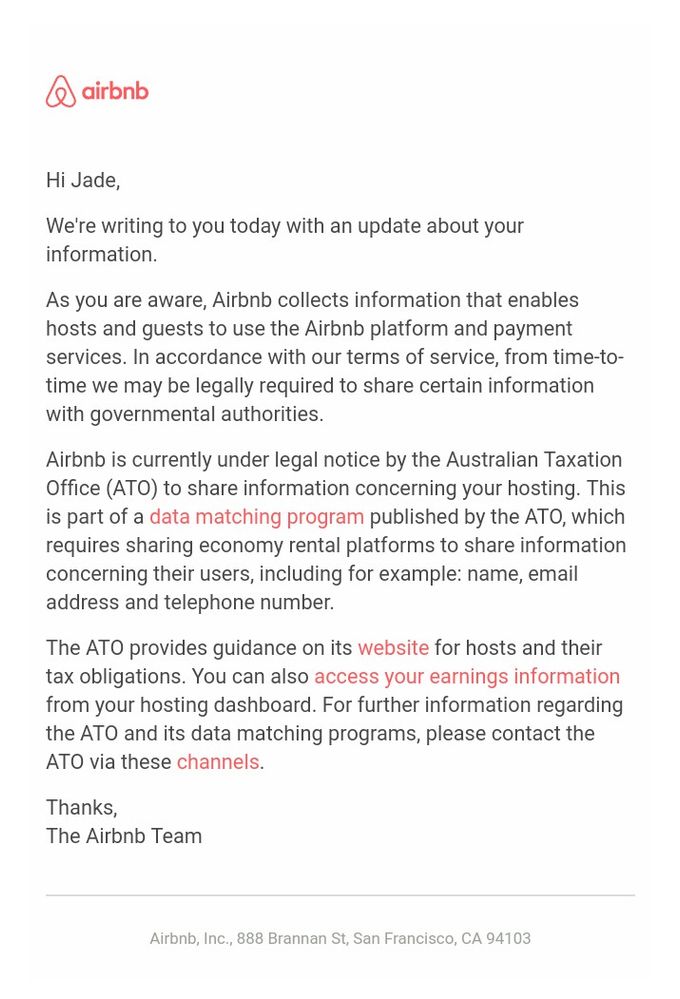

I am aware that Airbnb terms and conditions refer to the need to release information when necessary, however if a Notice is served upon Airbnb to release such information (which is what Airbnb state occurred in their email), then surely there is an obligation to show that Notice to the Hosts it relates to.

Whether that Notice is simply attached to their email or published on their website, as long as it is made available to the Host for transparency purposes.

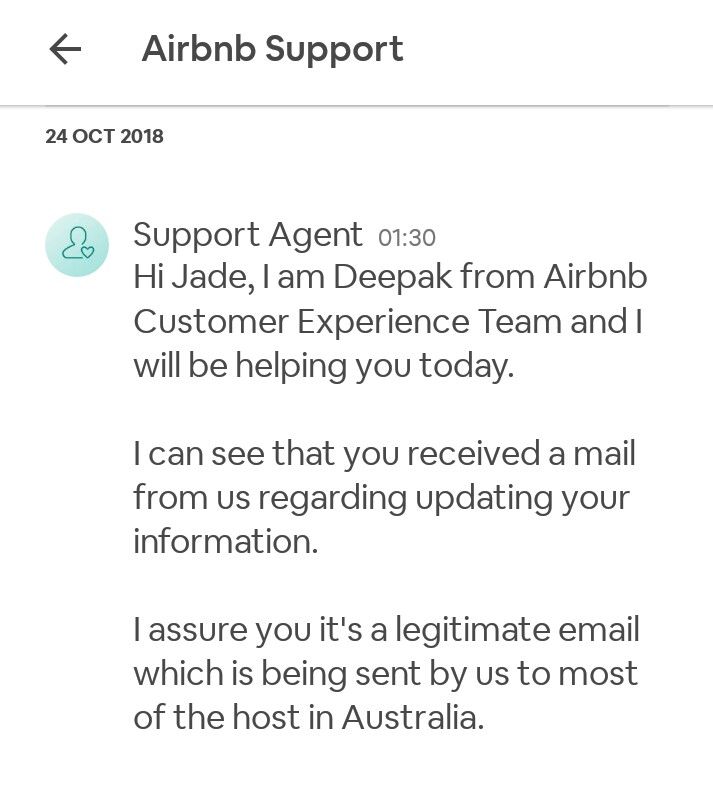

I actually requested a copy of the Notice from Airbnb when I questioned the legitimacy of the email they sent. As you can see by their response, they avoided responding to my request for the Notice. They also did not send me a copy of the Notice.

I wonder if anyone whom has received the email from Airbnb has seen the originating request for information that was issued by the ATO?