@Marcelo382

How awful to be put in that position! So sorry you’re dealing with this unnecessary stress.

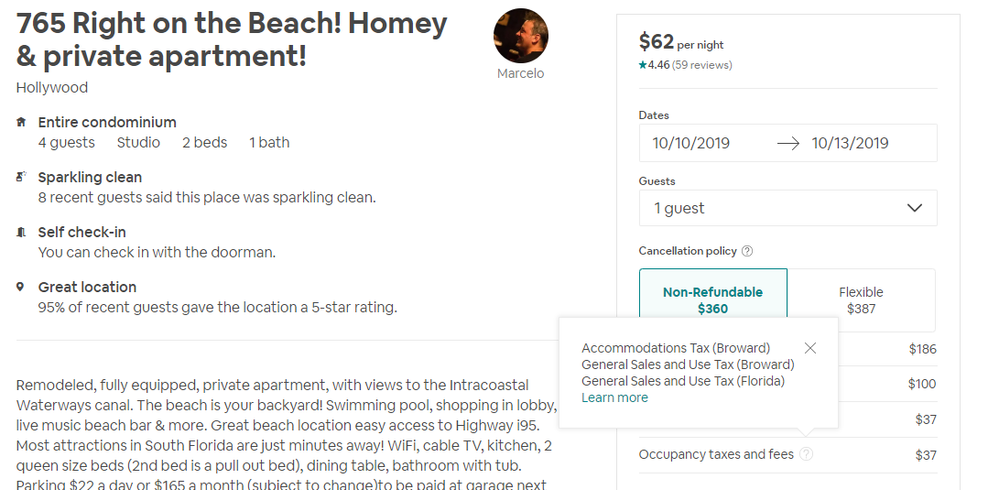

Ive not personally had the problem with Airbnb not taxes but I know others in NY and CT that do, and have the taxes collected by Airbnb but not paid to the taxing authority. In fact it’s earned Airbnb significant negative PR and inspired municipalities to ban Airbnb in some areas of the US. More personally it’s created a lot of difficulty and scrutiny for the hosts by the taxing authorities. They’ve had similar experiences trying to resolve the issues satisfactorily with Airbnb, but at least they’re not faced with needlessly stressful check ins and being forced to cancel a reservation like you are. They’re just being levied penalties, which really add up and often result in audits (see anxiety rising...)

I hope you’re letting your guests know this isn’t your doing so you can salvage your reviews. I used to live in Florida. Condo nazis are the worst, and Airbnb (lack if) support us an ongoing problem. When they “can’t” help me, I ask to be escalated to IT. In my experience, Management is often worse than the front liners with far less customer service finesse.

The only thing I can suggest to alert you before the final hour is to check each booking just after confirmation for taxes so there’s some hope of correction in advance of check in. If they’re not listed in the booking, call Airbnb to confirm/have them add it in, or collect it from the guest yourself so everyone’s not stressed out at check in...which (through no fault of yours) isn’t the greatest beginning to anyone’s stay and doesn’t reflect well on Airbnb either.

Be sure to mention somewhere in your listing that there is lodging tax and the rate so it’s there in case you have to address it.

Since Airbnb is so revenue/guest focused I’d also consider suggesting to the guest that THEY call Airbnb to complain. Based on experience, that’s likely to move them faster than any host concern.

We have a right to expect a professional booking platform to be just that. There are veteran superhosts who’ve moved on because of “irreconcilable differences” and my last booking here is the end of this month.

I’ve been a 5 star super host since I began listing without a gap and gave 25 years experience in customer service. I work hard to provide a stay that’s an exceptional experience, have received amazing guest reviews and guest book entries, thank you gifts, original art work and poetry and I’ve had my fill of the “support” shortcomings, constant unannounced changes in platform services, and ongoing internal problems that effect my publicly posted algorithms and search placement.