Ciao to everybody, today I got 2 requests for information, b...

Latest reply

Ciao to everybody, today I got 2 requests for information, but for both of them there was no sound notification on my phone. ...

Latest reply

When you sign up for Airbnb, it tells you that they collect taxes in Florida. Well, sort of. ONE COUNTY, Palm Beach County, does not participate.

When you read this: https://www.airbnb.com/help/article/2580/palm-beach-county-fl , it is still currently telling you to go to the County website to find out the rules. They don’t really post them, either.

You must collect the Palm Beach County Tourist Development Tax (TDT), and file it, manually, yourself. If you haven’t, taking Airbnb at the “We pay Florida Taxes, thing,” you will be fined for each late report, and still owe the 6% TDT.

Further, Airbnb does not collect the TDT. Here is how you can collect it yourself, though, through their system:

That will then collect the money needed to pay the local 6% tax.

Otherwise, the 6% comes out of your profits!

I just went back and caught up. It can be a bit expensive, with fines.

Why is Palm Beach the only county that does this? Can’t tell you. I asked. Got no answer. I would suspect that they like the fines. Otherwise, they would get 100% of the tax money through Airbnb.

Answered! Go to Top Answer

Wow! What a shock I got! I tried my best to follow all of the rules. I thought AirBnb was paying for the taxes - I can see that the guests have been charged! Were those only for the state of FL? Has AirBnb been paying them or am I going to get socked with a penalty for those as well?

I cannot believe that the County can penalize a whopping $50 per month when there explanation is so poor. i am appealing it, but who knows if that will work or not. OUCH!

Your help is 1000% better than either explanations on AirBnb or PBC websites. Thank you.

Wow! What a shock I got! I tried my best to follow all of the rules. I thought AirBnb was paying for the taxes - I can see that the guests have been charged! Were those only for the state of FL? Has AirBnb been paying them or am I going to get socked with a penalty for those as well?

I cannot believe that the County can penalize a whopping $50 per month when there explanation is so poor. i am appealing it, but who knows if that will work or not. OUCH!

Your help is 1000% better than either explanations on AirBnb or PBC websites. Thank you.

Yes, you are not alone. I asked the office why they do not just collect from Airbnb, where they are guaranteed 100% of the money. There is certainly profit motive from collecting those fines.

I paid them and made formal inquiry. I am going to see if we can organize a Palm Beach County thread. We should approach the Tax Collector as a unified group. We may need to hire someone, if they are of the mind to not return the fines. I talked to the prior owner of my place. She knew about it because they sent a letter out in 2018. They never followed it up, though, with putting the information on the web for anyone coming into the system AFTER that.

I also contacted Airbnb Support, and asked them to put the full disclosure about paying the tax on their Palm Beach County page. It is not enough to say “contact the tax authority” because you get too many conflicting stories out of people who work there. It’s not that difficult. You have to pay the tax, as Airbnb DOES NOT.

I am going over there on Monday. If I find out anything further, I will let you know.

Hi @Brian1613 Brian and thanks for your info, wish I'd of seen it long ago! Did you have any luck with this? I've been paying the TDT since 2019 when they required us to register and get set up but I was under the impression that was a new thing. The county clerk who registered me and too my check didn't say it wasn't new and that I owed for prior years so it came as a complete shock when I just got an almost $9000 bill this month for 2017 & 2018. I feel like it's fraud on the county side and it's not even possible for me to come up with that kind of money in my current financial situation. If you have any other info from your visit I would appreciate it. Thanks, Dee

Air BNB is collecting 13.5 % taxes on my listing located in Palm Beach County, Florida. The occupancy taxes of 6% dueto the county have to be paid and filed by myself. Air BNB "DOES NOT" have an agreement with Palm Beach county to pay and remit taxes on the owners behalf. Since Air Bnb is collecting these taxes shouldn't they be giving me the 6% to pay the Occupancy taxes since they already collected that tax from the guest? Air BnB has NOT given me any portion of the collected taxes. I have to pay them out of my own pocket. Can someone please help me and clarify this. Air BNB has been NO help in getting this resolved.

Does Air BnB owe me a portion of the taxes they collected to pay the counties Occupancy tax?

Mr. Ross thank you very much for your help, your information definitely came up to save me for a sure fine from PBC. I too was convinced that AirBNB was going to pay the collected taxes from guests. So, now I have a question that you may be able to answer, I just did the 6% as you said to put it under the "community fee" but what about the other tax that airbnb is already taking from guests?

And that 6% I just did it will apply to my booked reservations already in place for the weeks and months to come?

Thanks

any update? I paid 6 month worth of $50 fines. Only rented 3 times and they are threatening to place a tax warrant on my home. Will not let me go back and adjust and pay tax.

You have to post all taxes, even ZERO months, or they will fine you. This is why they do manual collection. The fines are good business. @Krisha--0

@Brian1613 Thanks, I sent you a direct message. I file zero every month but the auditor is challenging it.

@Marie5877 Any luck with the apeal? I am currently on the same boat any insight would be gladly appreciated.

No luck at all. I paid the late fees and put the info on my calendar each month to never forget again!

I got hit with a ton of late fees not knowing this, crazy. Do you know how I can go about the appeal process and were you succesful? Thank you

I filed this reply to my request to have them straighten out some other elements of my Tourist Development Tax Account:

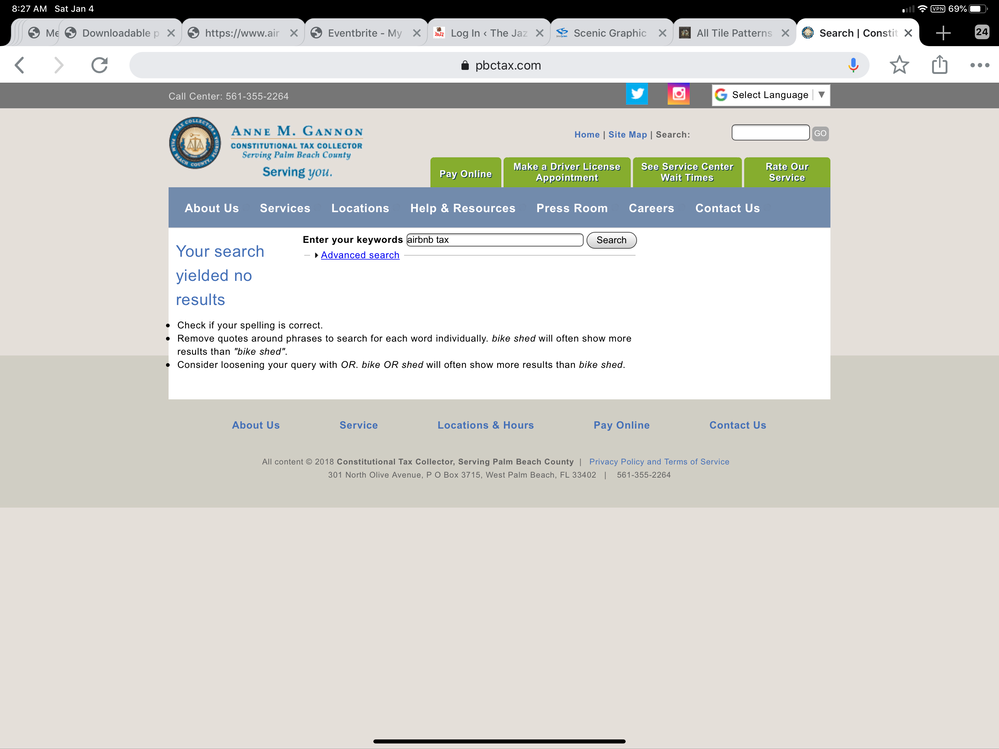

Other searches of your website popped up nothing on Airbnb, or other services, and the TDT. That leaves me with the conclusion that the information has not been provided to us by the taxation authority of the county.

Other searches of your website popped up nothing on Airbnb, or other services, and the TDT. That leaves me with the conclusion that the information has not been provided to us by the taxation authority of the county.CONTINUED, Next thread point

Hi @Brian1613 , @Steven1773 , @Marie5877 , @Stefanie465 , @Ramon625

First let me say, so sorry this is happening. Not all taxing jurisdictions have an agreement with Airbnb. It is confusing when Airbnb collects some of the taxes owed, but not all. They do advise that Hosts are responsible for determining what taxes are owed to what jurisdictions and the amount (%) of each booking is and how that is calculated. It gets even more confusing when each jurisdiction may have different methods for reporting and remitting the taxes owed and at what intervals.

Airbnb does allow Hosts to add a custom tax to their listing, but don't really make it clear how to do that. By adding a custom tax, the amounts will be correctly shown on each reservation as included in "Occupancy Taxes" as a line item. This also will then display as taxes in the Earnings information. This might make it easier for auditing purposes. @Brian1613 has come up with a workaround using one of the addl fees, but that will be added to the nightly rate and not display in the "taxes" field.

To Add a Custom Tax to Your Listing:

- Go to Your Account

- Click Professional Hosting Tools

Go to Listing Editor

Click preferences icon

Click Taxes

Add Custom Tax

Verify the custom tax is calculating correctly by trying to book your listing by hitting reserve. You'll see the reservation details appear and you can determine if the new tax has been added. We always suggest Hosts keep their own spreadsheet of every reservation with guest name, reservation number, number of nights, and breakdown the taxes by each jurisdiction manually. This makes it easy to determine correct taxes for each reservation.

Example of Tax Breakdown On a Reservation

Thanks for that, Joan! The problem is that, for Palm Beach County, for example, Airbnb will show that it collected TDT as well as Florida State taxes from the guests. That’s a problem. If we do as you say, then the guest is being taxed twice. We’ve never been able to get Airbnb Tax to be consistent about it, either. At one point, you could see that the tax was hiding in the gross. So we removed that added tax. Then the tax draw came back. We asked where it was, so we could use it to pay. CS provided no answers.