We have 2-bedroom cottage on a rural property in Queensland,...

Latest reply

We have 2-bedroom cottage on a rural property in Queensland, Australia listed on AirBnB. We have the cottage insured for buil...

Latest reply

Sign in with your Airbnb account to continue reading, sharing, and connecting with millions of hosts from around the world.

Hello fellow Canadian hosts,

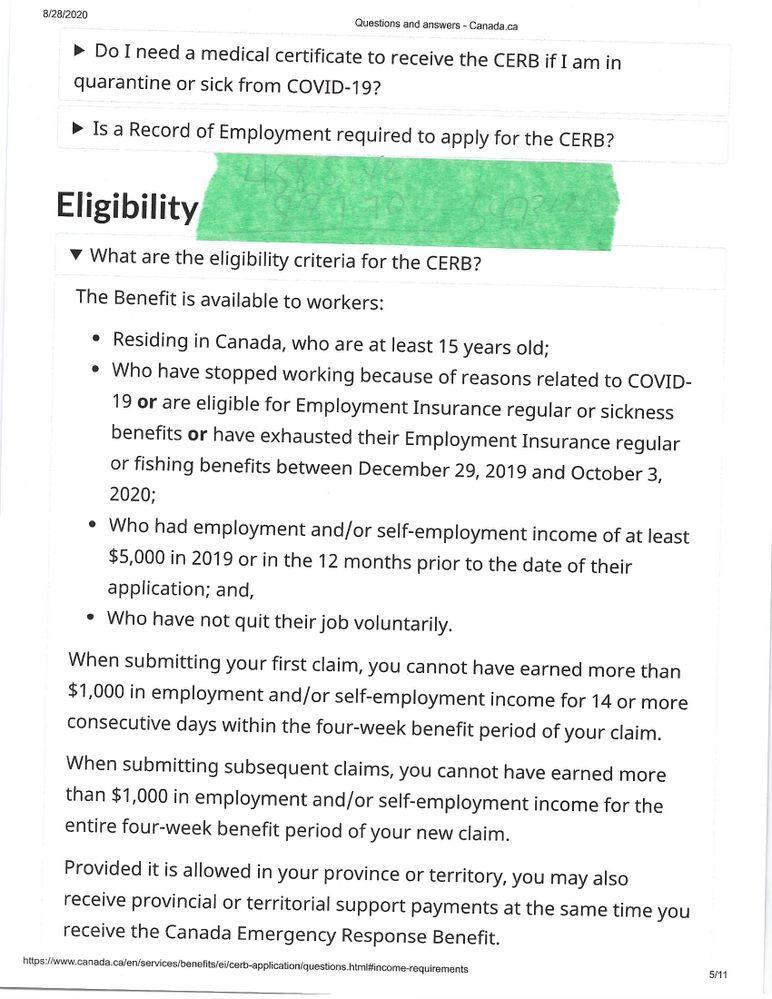

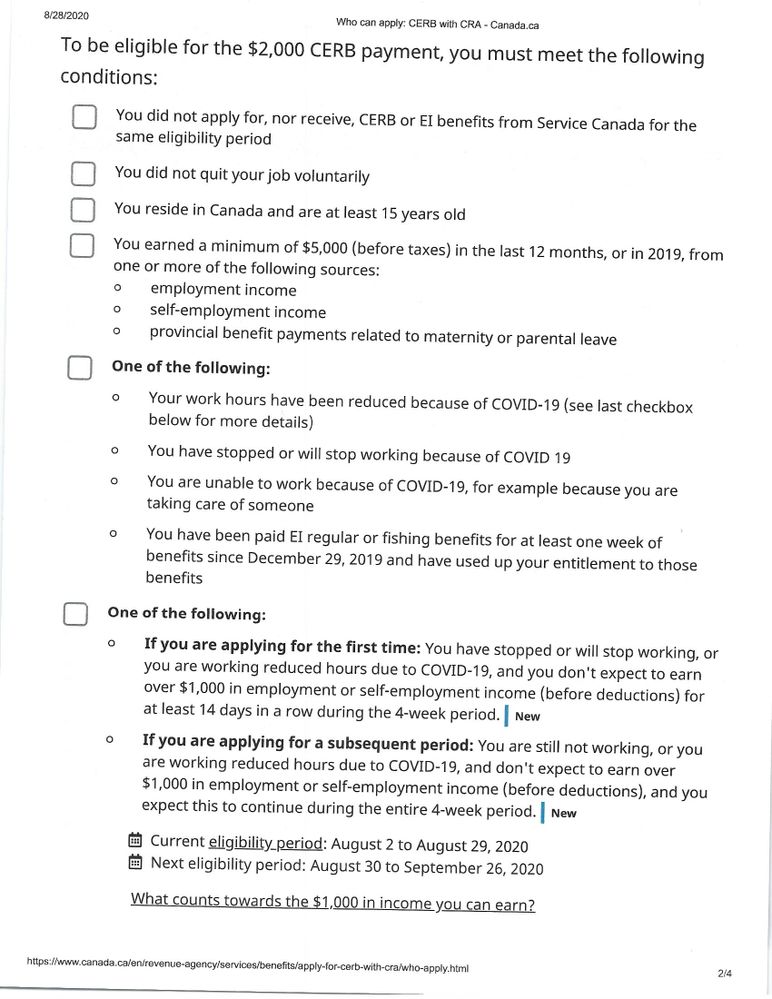

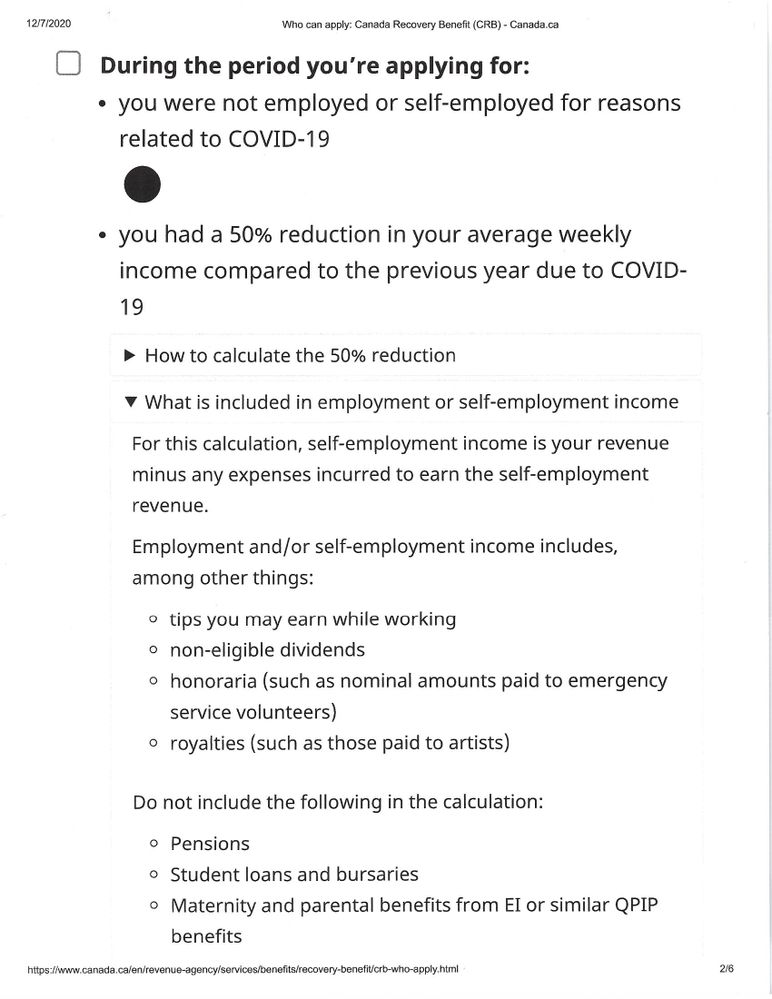

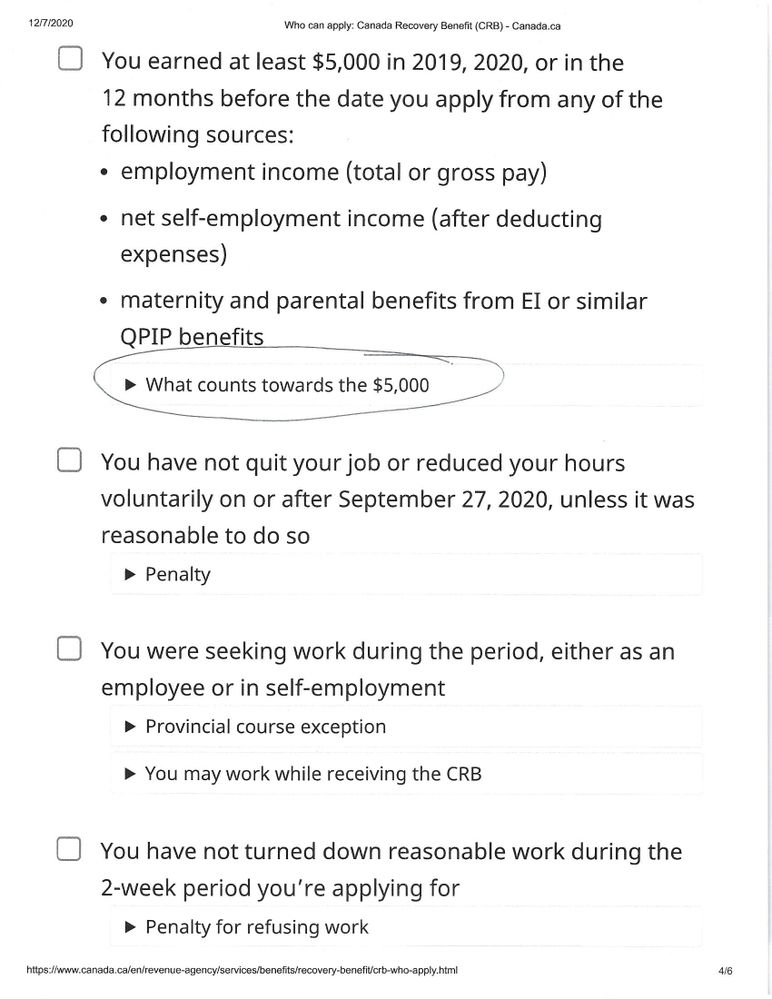

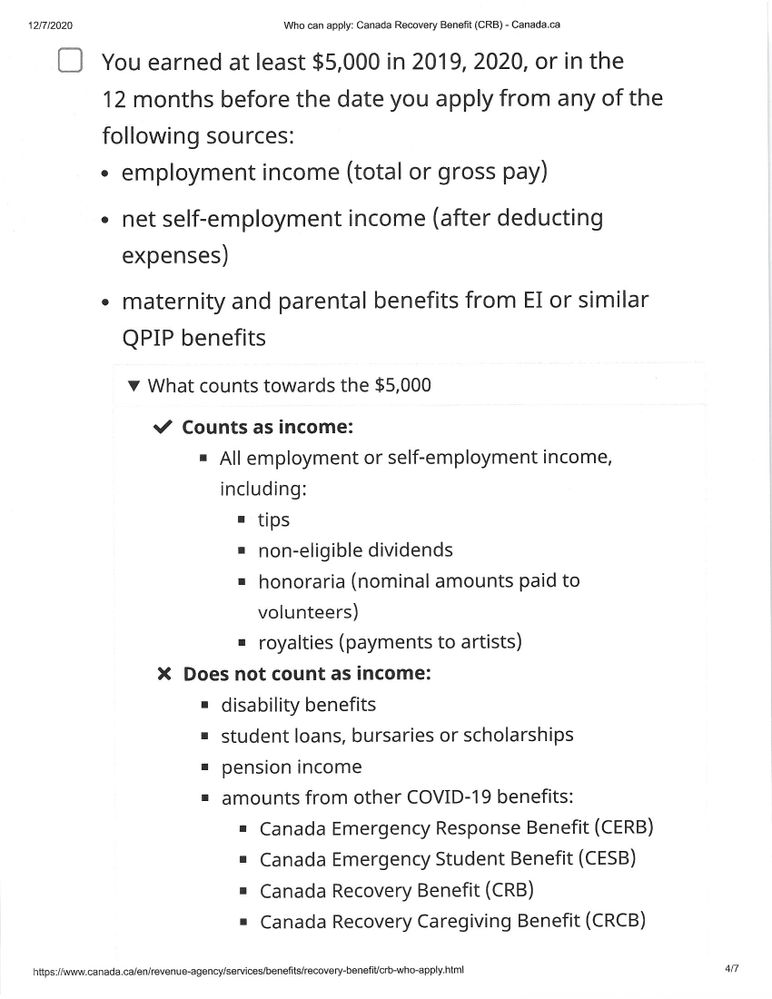

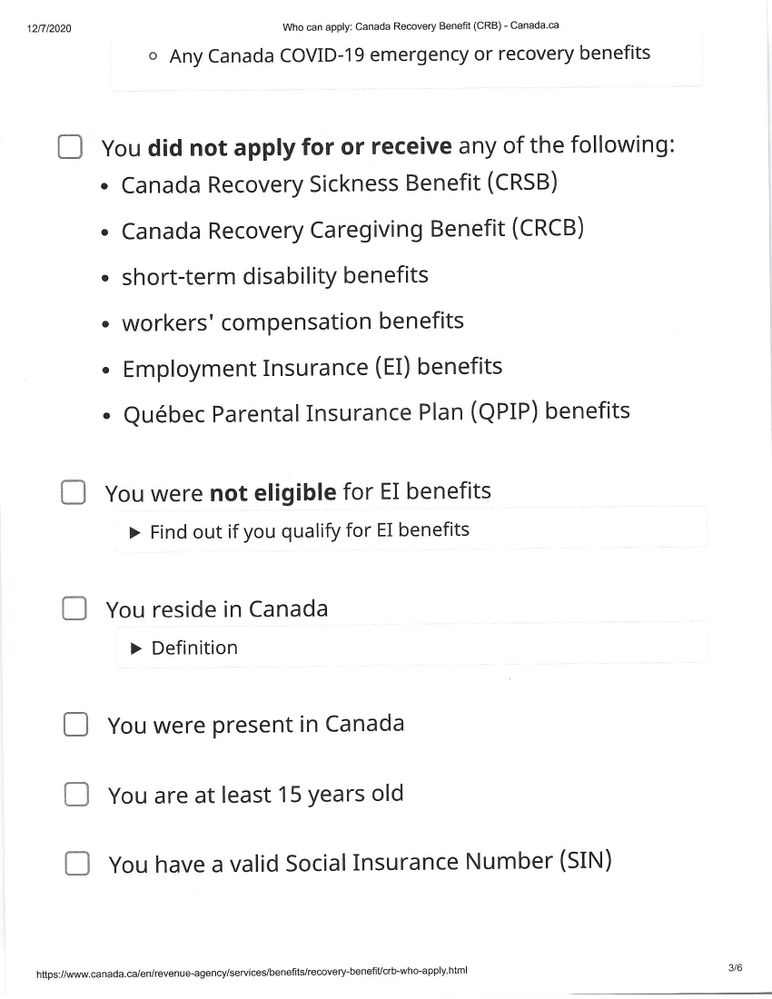

I'm wondering if others are facing the same issue: I claimed and received CERB and now CRB to compensate for my Airbnb income virtually drying up. I met all the criteria, including 'self employment' income of a minimum of $5000 in 2019, which I reported on my 2019 tax return.

On Friday I received a generic email stating that, according to their records, I didn't qualify and it listed options for repayment.

I spent a great deal of time on the phone seeking clarification and was advised to proactively submit proof of Airbnb income.

However, one agent, who conferred with his manager, said that, although there was no final decision, my Airbnb income doesn't appear to qualify for self employment, but rather as rental income arising from an investment.

I rent two bedrooms in my own home, my primary residence, so didn't buy investment property specifically to obtain rental income. I've owned the house since 2005 and only started hosting in 2017.

Maybe the fault lies with the way I reported the income, i.e. as rental income rather than self employment which seemed quite onerous and complicated.

I'd appreciate any thoughts, feedback from other hosts in Canada.

Thanks!

Paulette

I don't have property in Canada, but am responding to push your post to the general topics page, and hope that someone can assist you. I am also tagging a few Canadian hosts.

I am so glad I found this post. I'm on a second review right now and am arguing that my Whistler Airbnb income is active business income not passive rental income. I have long-term tenants which I claim as rental income but my Airbnb I run as a business and claim it as such. I just submitted over 130 pages to CRA as proof including my business license, the commercial zoning of my property, the sale of our second Airbnb that was GST exempt due to the commercial nature of the property that makes GST deferrable as long as it stays as tourist accommodation and is not used personally. I listed the meals provided ( instant oatmeal and cliff bars) plus all the other consumables from bath products, to tampons to ear plugs, to cooking oil. I also included my business number, my GST quarterly payments, occupancy taxes and Toursim Whistler mandatory fees to cover international advertising that is mandatory for all resort zoned properties. As well. I submitted the pages of guest interaction that included concierge style services from rental recommendations to what heli-skiing company to book with. Being both a landlord and a Superhost, I can say 100 percent as all of you can attest I earn this money hosting not just renting a space.

I would love for anyone who has had any success to comment.

I am so sorry to hear this @Paulette23 - it should have been self evident to your tax/grants people that STR income is not self employment

perhaps offer a repayment plan?

@Helen3 Thanks for your interest!

Actually I believe people working in the 'gig' economy (Airbnb hosts, Uber drivers and the like) are considered self-employed.

And I certainly do employ myself! ...to handle all the communication, clean, do laundry, make beds, shop for essentials, bake cookies, manage queries and issues and on an on.

The Canadian government says those receiving rental income from investments aren't eligible for this emergency assistance but I didn't buy my home as an investment. It seems to be a grey area, however, and I will pursue. I was just hoping other Canadian hosts could weigh in on their experiences.

Your not alone. I too rec'd a letter from CRA stating that my Bed'n Breakfast did not qualify for CERB as rental income is now not eligible. My accountant and I believed that I did qualify. I strongly advise that you contact your MP to voice what has happened. The more people that come forward to their MP's the more pressure they will feel to act on our behalf to the Finance Minister, Chrystia Freeland. Also contact her office and send an email. I've done both. We were truly blindsided and now we have been plunged into even more debt as a result of CRA's decision. I took a screen shot of both the CERB and CRB websites where they listed what qualified and what didn't. No where did it state that rental income was not eligible and ironically it is literally the very last word, in the email I rec'd from CRA, listed under incomes not considered employment or self-employment. Very convenient! Let me know how you make out with your MP. There must be many of us out there!

Hi @Marlene351 , I will also contact my local MP and the federal Finance Minister, why not?

As far as the CERB criteria, I also didn't see an explicit exclusion of rental income and unfortunately interpreted my rental income as self-employment (as I am actively engaged in the management of my little business). It may be irrelevant to our situation, but Australian hosts are considered self-employed, which just shows how different tax jurisdictions treat this activity differently and CRA might need to refine their thinking on this.

I'm only now seeing CRA's absurd distinction. For example, offering banana bread or blueberry muffins for guests (which I do), but not calling it a 'meal' means it's rental income and not business income. And yet if they eat the muffin for breakfast, doesn't that make it a meal?

Yes, the reference in the CRA email is confusing and my conversation with the agent only further confused the issue as he kept referring to my Airbnb rooms as "investment" (i.e. passive) income.

I've spoken to a couple of accountants for solutions and got contradictory advice, i.e. one said I could file an amendment and the other saying it would be disallowed.

Feel free to reach out to me at **.

**[Phone number hidden due to safety reasons - Community Center Guidelines]

Hi Paulette, Thanks for your shared information and I will definitely give you a call. I look forward to hearing what your MP had to offer and if they've heard from other people in our same situation. Talk soon.

Hi @Marlene351 I understand that this post was quite a while ago. I'm in the same situation and I'm still trying to prove my eligibility for CERB. You said " I took a screen shot of both the CERB and CRB websites where they listed what qualified and what didn't. " Do you still have this shot? If yes can you send it to me?

Thanks, Vincent

Hi @Bella-And-Vincent0 ,

I do have the 2 copies but they are in a word document form which I'm not able to upload here.

I could email them if you'd like to share your email address?

Regards,

Marlene

Hi Marlene, thx a million! my email address is ** are you still fighting it? sorry, will be easier to talk via email. have an awesome day.

Bella and Vincent

**[E-mail address removed due to safety reasons - Community Center Guidelines]

Hello @Bella-And-Vincent0, I just wanted to let you know that I had to remove your email since it is not allowed to share personal information in our Community Center. The easiest way to share this information with @Marlene351 is by sending her a private message. You can do this by clicking the button below her picture, similar to the one I am sharing here:

one more Paulette, our situation we are Airbnb our primary residence. we move out, rent something cheaper, clean ourselves and the difference between the rent amount we pay for a place we rent and what we make from our apartment is our income. we were still declined eligibility. judicial review is my last option but i have 10 days left and can't fill out the forms needed for the appeal. thank you for taking the time and sharing.