I am now already in a +10 day discussion with Airbnb on an i...

Latest reply

I am now already in a +10 day discussion with Airbnb on an issue of blocked days that are being switched to 'active' in the c...

Latest reply

Sign in with your Airbnb account to continue reading, sharing, and connecting with millions of hosts from around the world.

Dear Community,

Airbnb has detailed instructions (below) for collecting Occupancy Taxes through its Professional Hosting Tools (which I have turned on) except that when I get to Step 3, the "Add a tax" button does not appear - does anybody know why, or more importantly, how to do this? Many thanks.

------------------------

How to add custom taxes for individual listings

You’ll need to turn on professional hosting tools to access this feature.

If we don't already collect and remit taxes for your listing:

If we collect and remit taxes for your listing (default taxes):

If you remove all custom taxes, you’ll automatically switch to default tax collection.

It does appear at my local (Dutch) Airbnb website, and opens a pop-up window to add different taxes. I learned from other postings in this community this option is not available on the Airbnb website in the US (which you probably use)

Best regards,

Emiel

Did you ever get this resolved? I am having the same issue where I need to collect County Tax not collected by Airbnb. But there is no "Add a tax" button under Local Laws and Taxes even though professional tools is turned on.

I am in the US> Support told me it wouldn't work unless I created 5 dummy pages but kept them inactive. Did that but still doesn't work. Now they want me to make the pages live but block out all the dates. Don't want to do that. Any and all help greatly appreciated!

I was able to activate professional tools, but it appears I need to give a tax ID number to collect the local occupancy tax. Was this the case for you?

Yes. I activated professional tool. And I've added my tax id number to the listing so Airbnb collects the state tax. But there's no way for me to add or collect the local occupancy tax since Airbnb doesn't have an agreement with my county.

Yes, this did become the case eventually. Long in advance I had registered the properties with my state (MA) and they issued me a tax id number. I tried in vain for days to find out where it needed to go on Airbnb’s site - and it was long after the beginning date of the tax collection that I finally received a notice from them that I needed to provide them the id number, and they had actually created a place for it to go. It never actually involved professional hosting tools - fyi.

So by providing your tax id number, are you now able to collect both state and local taxes?

Airbnb will only collect and pay the state occupancy tax in Florida. They don't have an agreement with Osceola County to pay the local tax so I have to find a way to add it to the booking. I was told by Airbnb support that the only way to add a custom tax and have it paid directly to me (and then paid to the local authority) was through professional tools. I have professional tools turned on but there's no button "Add a Tax" to add the local custom tax.

Did someone find away around this? They have my tax id number to pay the state occupancy tax. My issue is paying the additional local tax...

With Professional Tools turned on, I go to Listings, pick a listing, then go to Local taxes and laws. I used the 'Add Tax' button down at the bottom to add both state level and city level Hotel Occupancy taxes. I then proceeded to ignore the warning that I increased my nightly rate as a result and should consider lowering my base rate.

@Patrick1224 I am also in Dallas and trying to figure out how to setup taxes. If you choose "custom", are you replacing the 7% automatically collected by the state of Texas?

In Texas, AirBnb collects the state tax by default and submits a lump sum to Texas each quarter. When I use the Custom option I am now required to pay both state and city tax so yes, I enter both a state level and a city level tax in AirBnb and I now pay both Dallas and Texas. That means I had to register with both the State and City and obtain a Texas Tax ID in addition to the Dallas Tax ID.

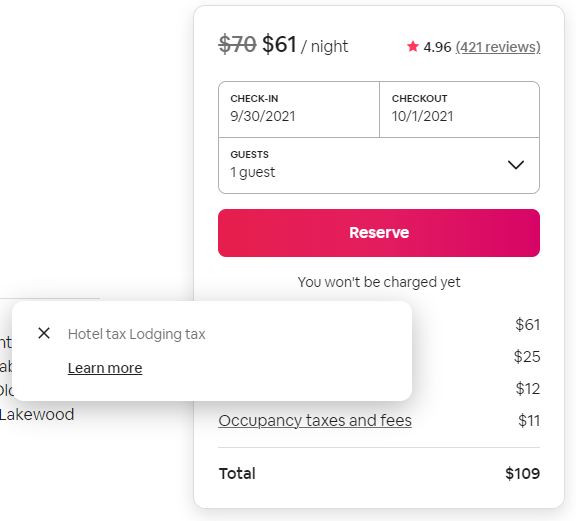

Below is what my guest will pay. Click on 'Occupancy taxes and fees' and you see the guest is charged 'Hotel tax' and 'Lodging tax' as I have configured in my custom options. I use 'Hotel tax' for the 6% State level tax and 'Lodging tax' for the 7% City level tax. You can see the guest is correctly charged a total of 13% of the nightly rate + cleaning fee ($61 + $25 X .13 = $11.18)

Below is for another host in Dallas. Click on 'Occupancy taxes and fees' and you see they are using the default 'Hotel Occupancy Tax (Texas)' and the guest is only paying 6% ($64 + $25 X .06 = $5.34). That means AirBnb is collecting and paying the Texas tax but this host is responsible for paying the Dallas tax out of their own pocket.

It is more effort remembering to pay the City and State taxes but by passing the city tax on to the guest literally saves me a couple hundred dollars each month and is very much worth the effort.

where is the accomadation tax registeration?

Did you ever find out this information? I am in DC and wondering if I need to register for the accommodations tax?